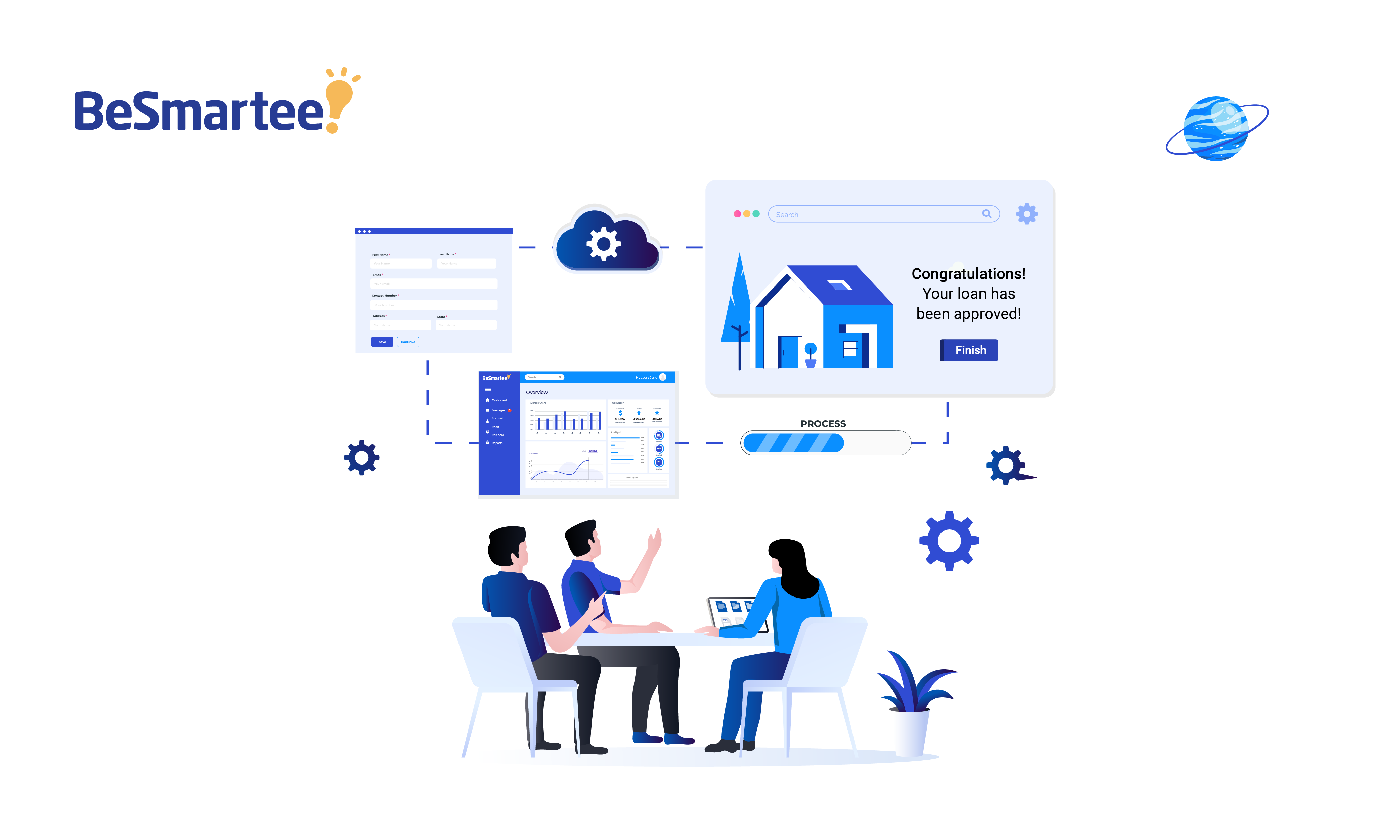

How Does a Point-of-Sale Fit Into a Mortgage Ecosystem?

Mortgage POS platforms bring efficient data management to lenders while delivering the online experience borrowers want.

Mortgage POS platforms bring efficient data management to lenders while delivering the online experience borrowers want.

Network with industry experts and experience technology first-hand.

BeSmartee dives into the CFPB’s recent warnings about the tidal wave of foreclosures incoming and what mortgage agencies should do.

After a booming year for the mortgage industry, BeSmartee is here to recognize the top producing loan officers of 2021.

BeSmartee dives into why lenders should prepare for more non-QM borrowers as the COVID-19 vaccine rolls out.

DACA recipients who can legally work in the U.S. are eligible to apply for an FHA-backed mortgage. Here’s how borrowers can benefit from BeSmartee’s Spanish multilingual mortgage POS, available out-of-the-box.

Go deeper into the origination process, faster.

Contact Us

Stevie winners celebrated during virtual awards ceremony.

BeSmartee's Spanish translation feature improves the digital mortgage lending experience for Hispanic borrowers.

BeSmartee® and Mortgage Builder® join forces to provide a complete digital mortgage experience for originators and borrowers for today’s new lending economy and beyond.

Realizing your vision for digital lending success through modern marketing tactics.

Jennifer Guidry of First United Bank shares her success story with BeSmartee.

BeSmartee’s new gen Mortgage POS empowers lending partners, amid the Coronavirus pandemic, with digital tools to successfully conduct business remotely.