Staying ahead in the mortgage industry requires constant innovation and a commitment to providing best-in-breed solutions. At BeSmartee, we understand the importance of evolution and are thrilled to announce the next chapter in our journey – the reintroduction of our mortgage POS, Bright POS.

Table of Contents

Embracing Change for a Brighter Future of Mortgage POS

Technology continues to reshape how we conduct business and the mortgage industry is no exception. The mortgage POS system has become a crucial component in the mortgage lending process, streamlining workflows and enhancing the overall borrower experience. With Bright POS, we aim to meet and exceed the evolving needs of lenders and borrowers in this digital age.

What Sets Bright POS Apart?

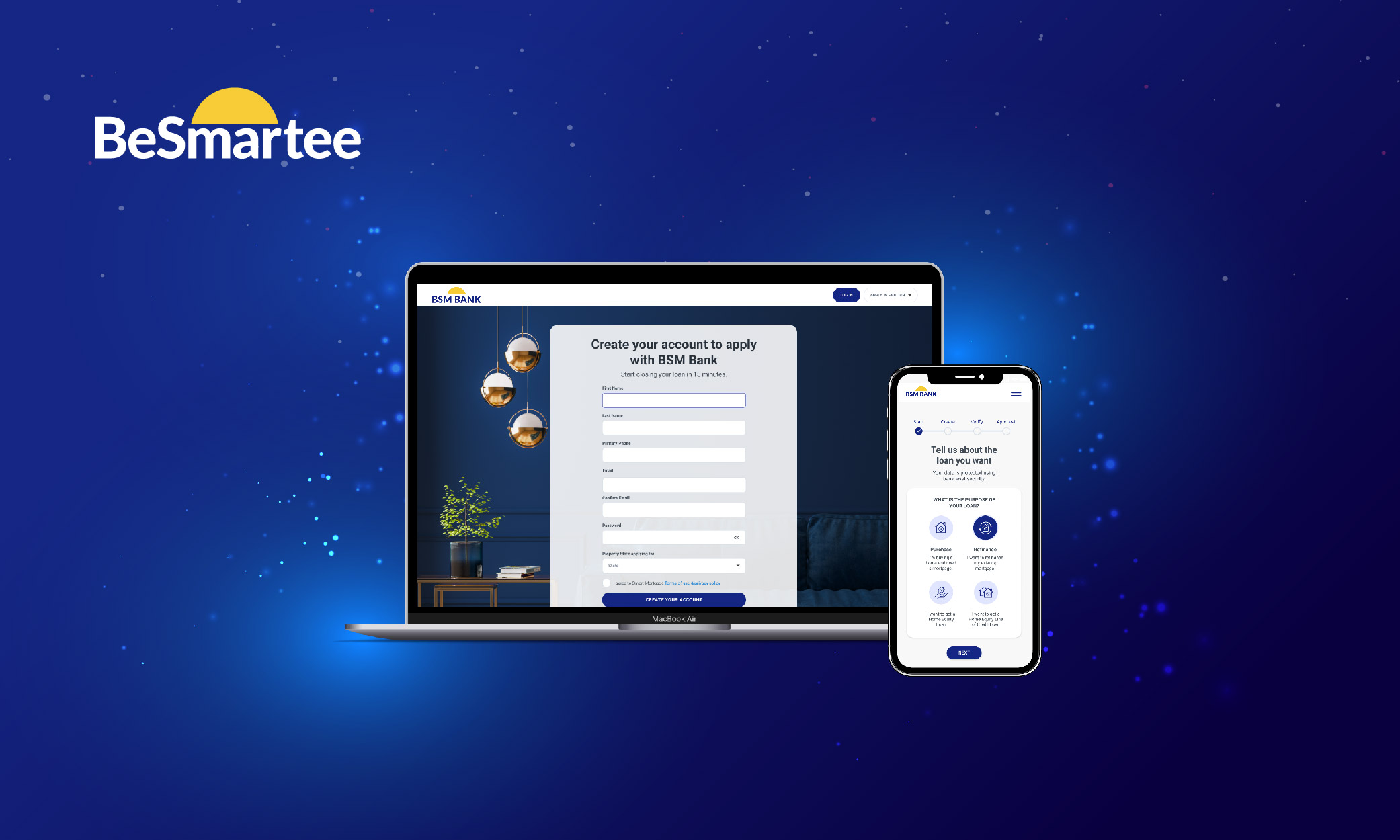

Modernized User Interface

Bright POS boasts a sleek and modern user interface (UI) to enhance user experience (UX) and streamline the mortgage application process. Our team of experts meticulously designed a visually appealing and intuitive interface that ensures smooth navigation for lenders and borrowers.

Enhanced Configurable Features

Empowering lenders with unparalleled flexibility, Bright POS presents advanced configurable features tailored to meet the diverse needs of our clients. Our platform allows lenders to easily customize it to adhere to their unique branding guidelines, fostering a seamless integration with their current systems.

This adaptability enhances the overall user experience and empowers lenders to uphold a steadfast and cohesive brand identity throughout every stage of the mortgage application journey.

Streamlined Communication Channels

Communication is vital in any successful lending process. Bright POS introduces streamlined communication channels facilitating real-time interactions between borrowers and lenders. From document uploads to status updates, the platform ensures that all stakeholders are informed and engaged throughout the mortgage journey.

Seamless Integration with Third-Party Systems

To simplify the lending process further, Bright POS seamlessly integrates with third-party systems commonly used in the mortgage industry. Whether it’s credit reporting agencies, title companies, or other essential tools, our POS solution enhances efficiency by connecting all the necessary components into one cohesive platform.

The Benefits of Choosing Bright POS

Improved Efficiency

With a user-friendly interface and streamlined workflows, Bright POSt significantly improves the efficiency of the mortgage lending process. Lenders can process applications more swiftly, reducing the time it takes to move from application to approval.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Enhanced Customer Experience

The borrower’s journey is at the core of Bright POS’s design. From a simplified application process to transparent communication channels, the platform ensures borrowers have a positive and empowering experience throughout their mortgage application.

Configuration for Lender Needs

The enhanced customization features of Bright POS cater to the unique requirements of each lender. Whether it’s branding elements or integration with specific systems, the platform adapts to the individual needs of our clients.

Future-Ready Technology

Bright POS is not just a solution for today; it is designed to be future-ready. As technology evolves, so will our platform, ensuring that our clients always have access to the latest tools and features in the ever-changing mortgage industry landscape.

Roundup

Bright POS marks a significant milestone in redefining the mortgage lending experience. With a modernized user interface, enhanced customization features and a refreshed brand identity, we are confident that Bright POS will set a new standard for mortgage point-of-sale solutions.

In a rapidly evolving industry, choosing the right mortgage POS solution is crucial for staying competitive and providing an exceptional borrower experience. Bright POS is not just another POS solution; it’s a commitment to a brighter future for lenders, borrowers and the entire mortgage ecosystem.

Join on an exhilarating adventure with us as we persistently pioneer and enhance the benchmarks of excellence within the realm of digital lending. To experience Be Smartee’s Bright POS, contact us today!