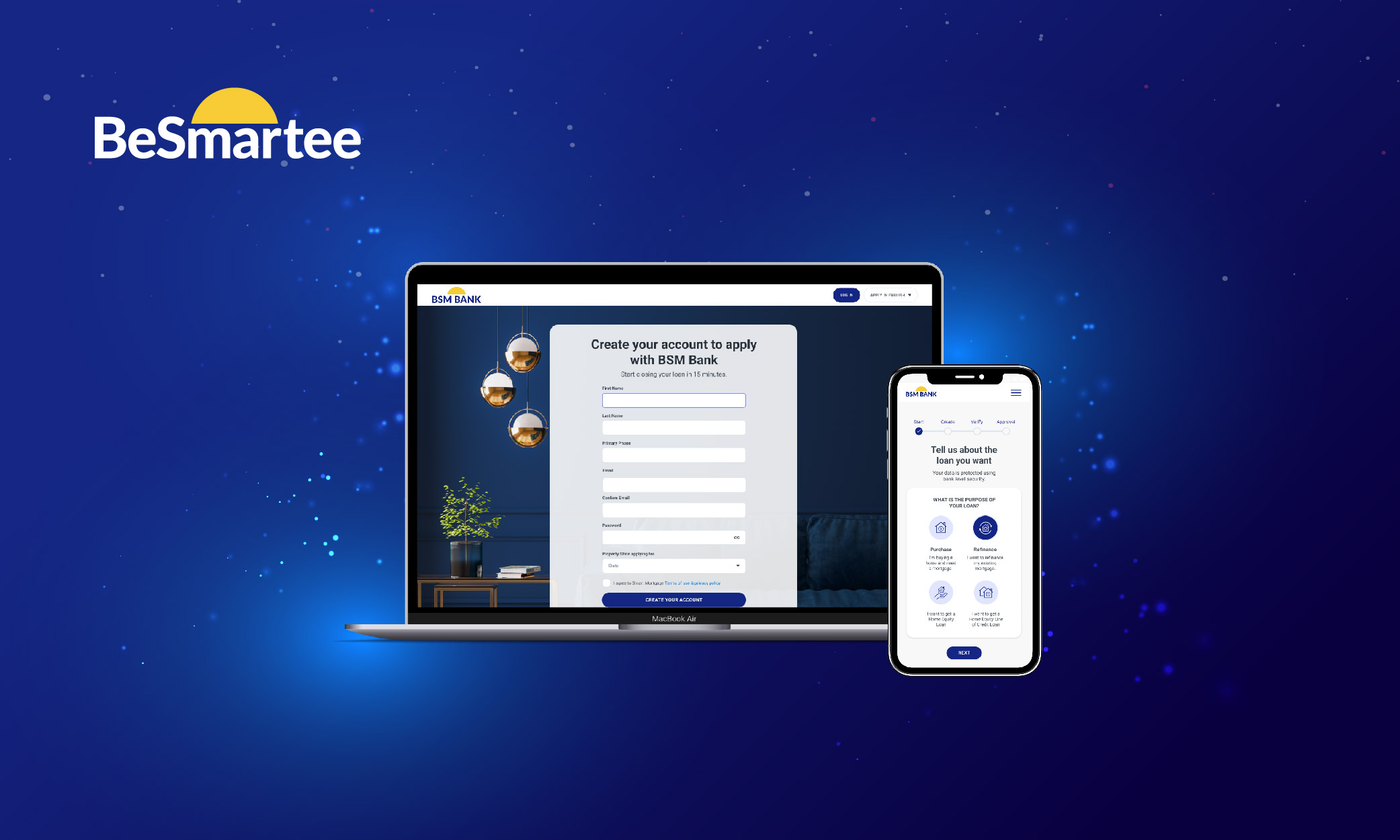

ALISO VIEJO, Calif., January 30, 2024 — BeSmartee, a premier provider of lendtech solutions, reaffirms its commitment to making digital lending powerfully simple with the re-introduction of its mortgage point-of-sale (POS) solution, Bright POS. This innovative solution is characterized by a strategic trifecta, featuring an enhanced user interface & experience (UIX), automation features and innovative AI applications.

The modernized user interface ensures effortless navigation, minimizing learning curves, and delivering a world class consumer experience, resulting in an 80-85% application start-to-submit conversion rate.

With advanced automation and AI applications, Bright POS helps financial institutions and independent mortgage bankers (IMBs) to achieve maximum operational efficiencies. From data collection to document tracking, BeSmartee’s POS technology reduces the time from application to closing by 10 days, saving lenders valuable time and costs.

“Bright POS represents our dedication to providing lenders with the technology they need to thrive in today’s market,” said David King, Chief Operating Officer at BeSmartee. “The enhanced usability, automation and AI position Bright POS at the forefront of mortgage POS solutions.”

Amidst rising interest rates, economic uncertainty, legacy system constraints and evolving customer expectations, lenders face a daunting landscape. Bright POS sets a new standard in mortgage technology, empowering lenders for success.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

For more information about Bright POS, schedule a consultation with BeSmartee’s loan technology experts at besmartee.com/contact.

About BeSmartee

Founded in 2007, BeSmartee powers $25B+ in digital mortgages every month for the world’s largest lenders and brands by delivering on its mission to make digital mortgages powerfully simple for consumers, borrowers and referral partners. BeSmartee’s digital mortgage solutions deliver automation of data and processes to achieve maximum operational efficiencies, a modern consumer experience that your consumers will trust and an innovative white-labeled native mobile app across retail, consumer direct and wholesale lenders. BeSmartee remains focused on its vision to deliver a 7-day mortgage close. Partner with BeSmartee and join 150+ lenders who rely on us to achieve an easy, fast and transparent digital mortgage.