Manual tax return spreading is a laborious and time-consuming process for commercial lenders. Historically, underwriters would spend hours transferring a company’s financial records into spreadsheets. This process, called spreading, would take up a majority of an underwriter’s time, resulting in slow decision times and room for error.

However, with automated tax return spreading software, financial institutions now have access to advanced technologies, such as Optical Character Recognition (OCR) and Artificial Intelligence (AI), that can streamline and automate this task.

Table of Contents

What Is an Electronic Tax Reader?

An electronic tax reader is a tool that automatically imports information from business and personal tax returns. This technology “scrapes” the data from scanned or digital tax returns and instantly converts this information into comprehensive financial reports with little to no human interaction.

Your time is valuable. Automated tax return spreading software allows financial institutions to automate their spreading process, enabling lenders to make error-free and data-driven credit decisions. Instead of spending hours manually spreading deals, it only takes seconds with the click of a button.

How Does FlashSpread’s Electronic Tax Reader Work?

With FlashSpread’s electronic tax reader software, financial institutions are able to:

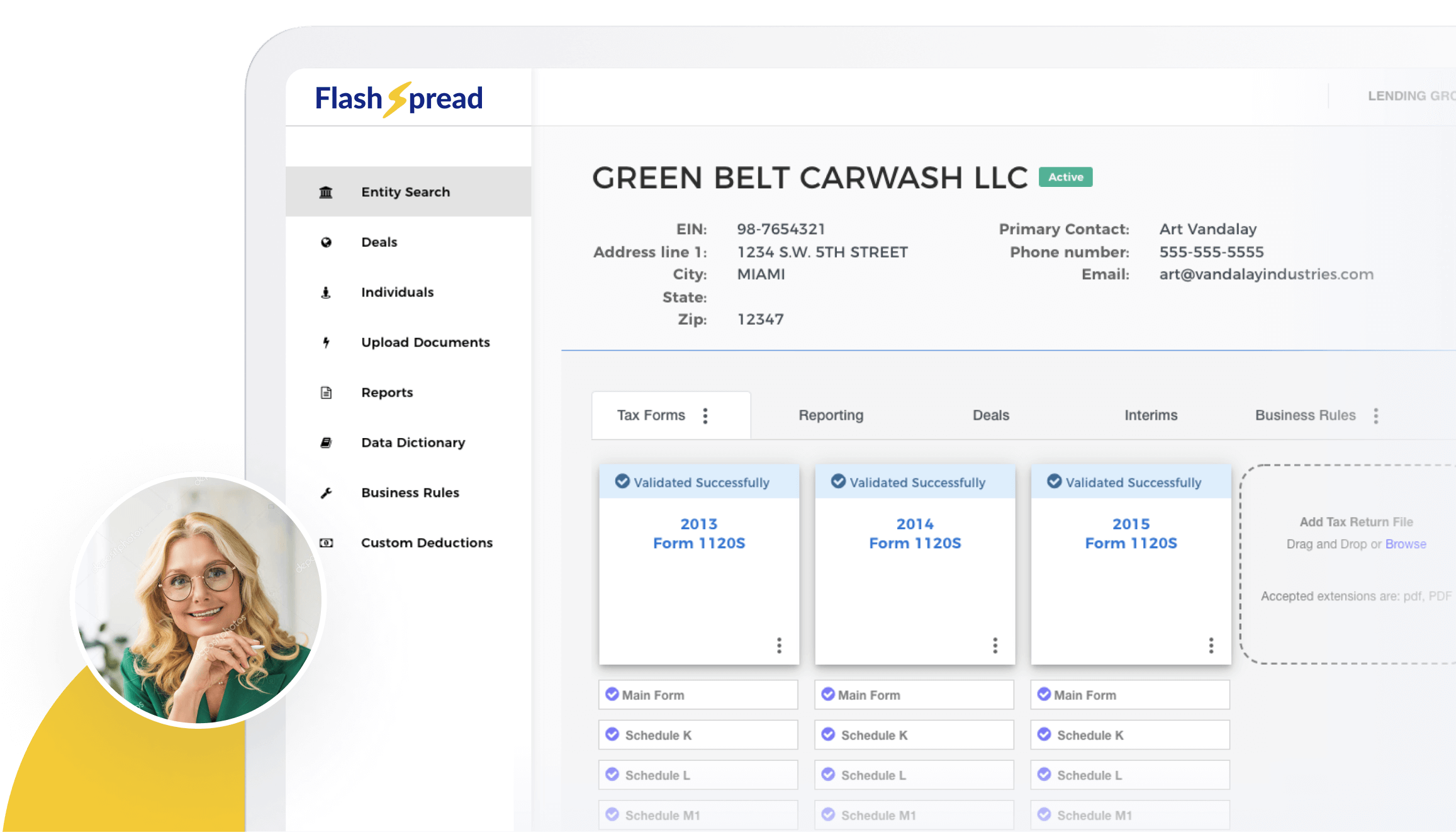

- Upload data to the FlashSpread platform by either scanning PDF copies of tax returns or dragging and dropping files.

- FlashSpread will automatically populate data using OCR, AI and proprietary algorithms. The user is quickly alerted if there are any mistakes or missing information.

- Analytic tools are available to generate reports on:

- Cashflow

- Balance sheets

- Income statements

- Entity cashflow

- Individual cashflow

- Global analysis

Plus, these tools can be customized with no code required, allowing your team to generate an accurate debt service coverage ratio (DSCR) in just minutes.

How an Electronic Tax Reader Helps Lenders Streamline Their Tax Data Retrieval Process

Electronic tax reader software speeds up the lending process, but this isn’t the only benefit. Here are several ways this technology can help financial institutions capture and interpret relevant tax data.

Accuracy and Efficiency

Manual data entry can lead to costly mistakes when it comes to financial spreading, for businesses and borrowers. In some situations, it can spell legal trouble if these financial documents were later proven to be unreliable.

Inaccurate information is also bad for the borrower, as it can lead to an incorrect decision about the borrower’s ability to repay the loan, high interest rates and late fees. This can even impact their ability to qualify for a loan in the future if it affects their credit score.

Consistency and Better Organization

Your business can now stay consistent by standardizing the spreading process, ensuring consistent data capture with every document and customer.

Having all tax data in one location also allows financial institutions to stay organized. No more searching for documents, saving your (and your customers’) valuable time.

Timely Retrieval of Tax Data

The more time is spent on manual data entry, the less time is spent on closing loans or building relationships with customers.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Instead of scanning individual tax returns and putting the data into spreadsheets, you can upload the PDFs into the electronic tax reader software and focus on other business tasks that require your attention.

Quick decision-making gives lenders a competitive advantage and a positive reputation in the market. Fast decision-making helps establish a relationship with borrowers and demonstrates reliability and professionalism. This can lead to repeat business, referrals and long-term partnerships.

Compliance and Audit Trail

Automated electronic tax reader software ensures your business remains compliant. Laws and regulations require financial institutions to report tax-related information, and electronic tax reader technology helps your commercial lending business accurately extract and validate sensitive tax data.

Digital documentation also provides an audit trail that underwriters can use to support their decisions, if necessary.

If the proper precautions aren’t taken, there’s a risk of non-compliance, even if it was unintentional. This can result in fines, fees and time in court.

Improved Risk Assessment

Underwriters use tax returns as part of performing risk assessments on potential borrowers. This is critical in assessing a borrower’s creditworthiness and determining the risk associated with taking out a loan.

Automated tax return spreading software gathers data from the business’s financial statements, tax returns and other documents into an easily digestible template. This template is then sent to financial analysts who interpret the data, conduct risk assessments and evaluate the likelihood of defaulting on the loan. The analysts send their recommendations to the loan officer responsible for making the final decision.

By hand, this process takes weeks. But with automated tax return spreading, it takes days or even less. Automated spreads provide financial institutions with reliable tax data, helping them make informed lending decisions and manage risk effectively.

Reduce Costs

By automating the tax data extraction process, financial institutions can save on costs associated with manual data entry, data validation and error correction. This can result in significant cost savings over time, especially for commercial lenders that process a large volume of tax returns on a regular basis.

By reducing operational costs, your team can focus on generating more business and building customer relationships.

Automated Tax Return Spreading for Fast and Accurate Loan Decisions

Automated tax return spreading helps financial institutions speed up the lending process without sacrificing quality. Electronic tax reader software enables businesses to stay organized, compliant and make informed lending decisions while keeping operational costs low. Get your time back with each tax return and focus on what truly matters — your customers. For more information on FlashSpread’s automated tax return spreading platform, schedule a demo with one of our specialists today!