In the fast-paced world of commercial lending, efficiency and accuracy are paramount. Streamlining processes, reducing manual errors and accelerating decision-making can make all the difference in a competitive market. This is where innovative technologies like FlashSpread come into play, revolutionizing how commercial lending processes are managed and executed.

In this blog post, we will explore the challenges faced by commercial lenders, the importance of productivity in this sector and how FlashSpread is making waves in optimizing commercial lending processes.

Table of Contents

The Commercial Lending Landscape

Commercial lending is a complex landscape involving many tasks, including loan origination, underwriting, credit analysis, risk assessment and more. Lenders must navigate through vast amounts of data, adhere to regulatory compliance and make well-informed decisions within tight timelines.

Traditional methods often involve a manual and paper-intensive approach, leading to inefficiencies, delays and increased likelihood of errors.

Challenges in Commercial Lending

Several challenges plague the commercial lending sector, hindering its potential for growth and efficiency. Some of the key challenges include:

1. Manual Processes

Many commercial lending processes rely heavily on manual data entry and analysis, making them time-consuming and prone to errors.

2. Data Overload

Commercial lenders deal with vast amounts of data from various sources. Managing, analyzing and extracting actionable insights from this data can be overwhelming without the right tools.

3. Regulatory Compliance

The lending industry is subject to stringent regulatory requirements. Ensuring compliance with these regulations adds more complexity to the lending process.

4. Inconsistent Workflows

A lack of standardized workflows can lead to consistency across different stages of the lending process, causing confusion and inefficiencies.

5. Slow Decision-making

Delays in decision-making can impact lenders’ competitiveness. Speed is often essential in commercial lending, especially when meeting businesses’ financing needs.

Importance of Productivity in Commercial Lending

Productivity is a crucial differentiator for commercial lenders in a highly competitive market. Here’s why boosting productivity is vital:

1. Faster Turnaround Times

Accelerating lending processes enables lenders to provide faster loan approvals and disbursements. This agility can be a significant advantage in attracting and retaining clients.

2. Reduced Operational Costs

Streamlining processes and minimizing manual interventions can lead to cost savings. Automated workflows and advanced technologies can reduce the operational expenses associated with traditional lending methods.

3. Improved Accuracy

Automation reduces the risk of human errors, ensuring that data is processed accurately. This is particularly important in lending, where precision in data analysis can directly impact risk assessments and decision-making.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

4. Enhanced Customer Experience

Quick and efficient lending processes contribute to a positive customer experience. Businesses seeking financing appreciate lenders who can promptly meet their needs without unnecessary delays.

5. Adaptation to Market Dynamics

The lending landscape is dynamic, with market conditions and customer needs evolving rapidly. Productive lenders can adapt more swiftly to these changes and stay ahead of the curve.

FlashSpread: Revolutionizing Commercial Lending

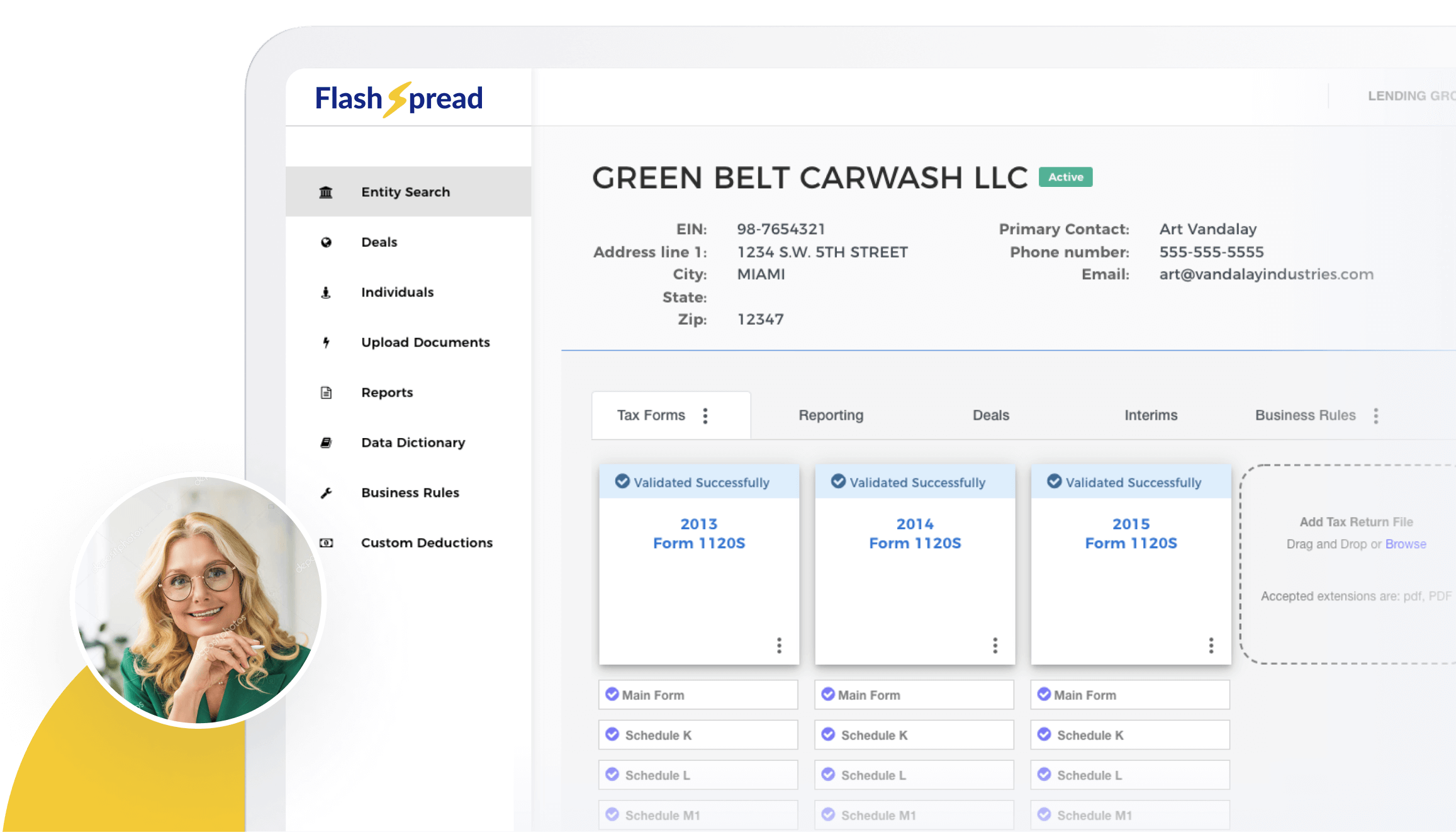

Enter FlashSpread – a cutting-edge platform designed to address the challenges faced by commercial lenders and supercharge productivity. Here’s how FlashSpread is making a significant impact:

1. Automated Data Entry and Analysis

FlashSpread leverages advanced automation and machine learning algorithms to streamline data entry and analysis. This reduces the time and effort spent on manual tasks, allowing lenders to focus on high-value activities.

2. Real-time Risk Assessment

The platform provides real-time risk assessment capabilities, enabling lenders to make informed decisions quickly. By analyzing many data points, FlashSpread enhances the accuracy of risk evaluations, contributing to more reliable lending decisions.

3. Intuitive Interface

FlashSpread features an intuitive and user-friendly interface that promotes workflow consistency. This ensures that all team members, from loan officers to credit analysts, can easily navigate the platform and collaborate seamlessly.

4. Compliance Management

Staying compliant with regulatory requirements is simplified with FlashSpread. The platform incorporates compliance checks into its workflows, reducing the risk of oversights and ensuring that lenders operate within the bounds of the law.

5. Collaboration and Communication

FlashSpread facilitates collaboration among team members through its integrated communication tools. This ensures stakeholders can easily communicate, share insights and work together towards common lending goals.

6. Customizable Workflows

Recognizing that different lenders may have unique processes, FlashSpread offers customizable workflows. This adaptability allows lenders to tailor the platform to their needs, promoting consistency and efficiency.

7. Enhanced Reporting and Analytics

FlashSpread provides robust reporting and analytics capabilities, empowering lenders with actionable insights. The platform’s analytics tools enable lenders to track key performance indicators, identify trends and make data-driven decisions.

Roundup

In the competitive commercial lending landscape, where time is money and accuracy is paramount, technologies like FlashSpread are game-changers. By optimizing and automating various aspects of the lending process, FlashSpread not only boosts productivity but also enhances commercial lenders’ overall efficiency and competitiveness.

As the industry continues to evolve, embracing innovative solutions like FlashSpread will be essential for those seeking to stay ahead in the dynamic world of commercial lending. Contact FlashSpread today to optimize your commercial lending processes.