In the world of finance, timely and accurate decision-making is paramount. Financial professionals need tools that can help them quickly assess their Profit & Loss (P&L) statements to make informed choices. Fortunately, the advancement of financial technology has provided innovative solutions to address this need.

One such solution is FlashSpread, a powerful tool that enhances decision-making through efficient P&L analysis. In this blog post, we will delve into the world of FinTech and explore how FlashSpread can revolutionize the way businesses analyze their financial data to maximize profitability.

The Financial Technology Revolution

Financial technology, or FinTech, refers to the use of technology to streamline and improve financial services. Over the past decade, FinTech has transformed the financial industry by introducing innovative tools and solutions.

These advancements have not only made financial services more accessible but have also enhanced the quality and speed of decision-making processes. One crucial area where FinTech has made a significant impact is in the analysis of financial statements, particularly P&L statements.

P&L Analysis: The Backbone of Financial Decision-Making

The Profit & Loss statement, often referred to as the income statement, is a financial document that summarizes a company’s revenues and expenses over a specified period. It provides a snapshot of a company’s financial performance, making it an invaluable tool for decision-makers.

Effective P&L analysis is the cornerstone of financial decision-making, as it helps businesses:

1. Evaluate Profitability

P&L statements allow organizations to gauge their profitability by comparing revenue to expenses.

2. Identify Trends

Analyzing historical P&L data helps identify trends in revenue and expenditure, offering insights into the company’s financial health.

3. Make Informed Decisions

P&L analysis informs decision-makers about the effectiveness of various strategies, enabling them to make data-driven choices.

The Challenges of Traditional P&L Analysis

While P&L analysis is crucial, traditional methods of analyzing financial statements can be time-consuming and error-prone. These methods often involve manually inputting data into spreadsheets, which can lead to human errors and delayed decision-making.

As businesses grow, their financial data becomes increasingly complex, making manual analysis even more challenging.

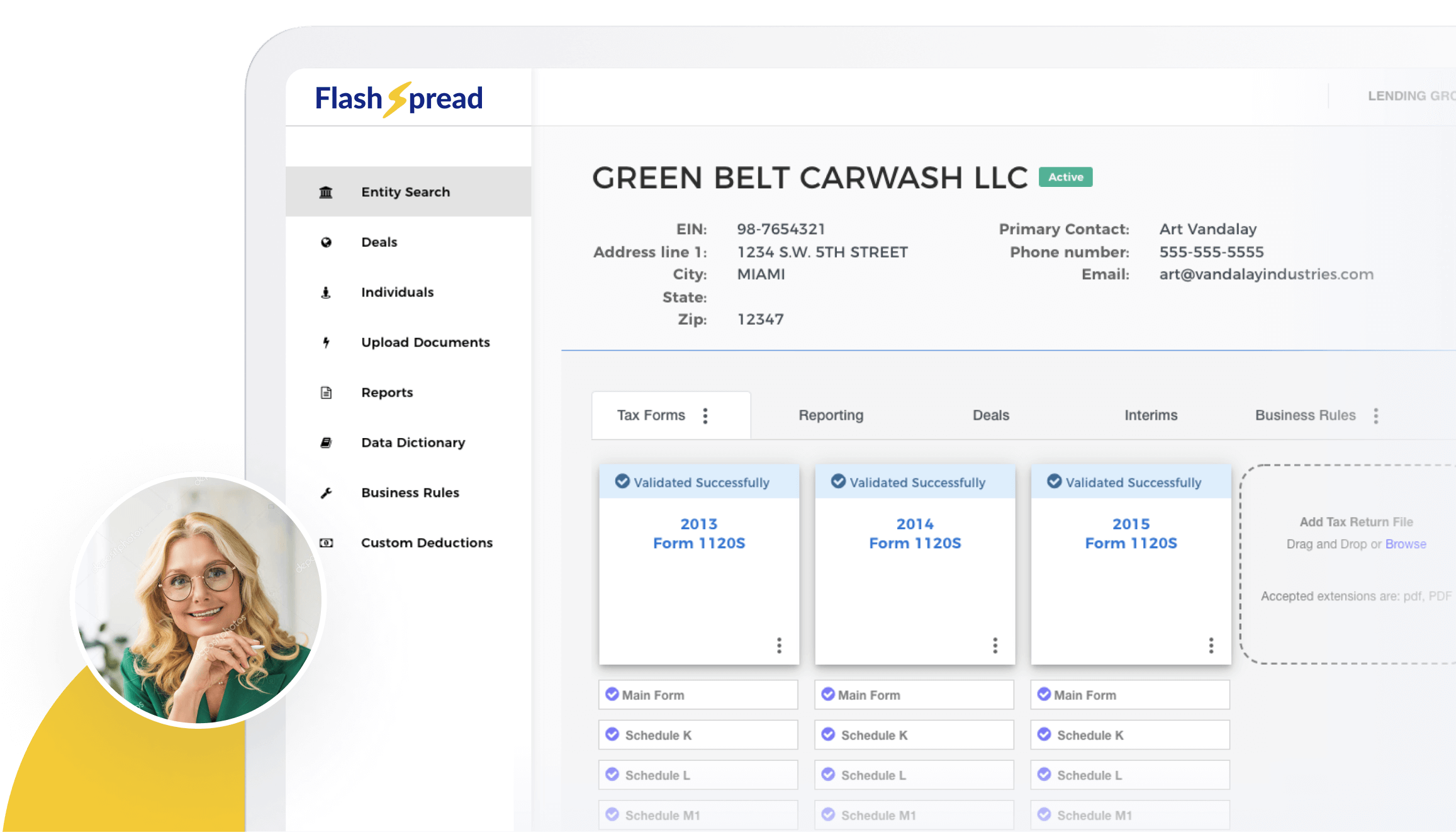

Introducing FlashSpread: The Financial Technology Solution

FlashSpread is a cutting-edge tool designed to streamline P&L analysis. It offers a range of features that simplify and accelerate the decision-making process:

1. Automation

FlashSpread automates the process of importing financial data, reducing the risk of errors associated with manual data entry. This automation saves time and ensures data accuracy.

2. Real-Time Updates

With FlashSpread, P&L statements are updated in real-time, providing decision-makers with the most up-to-date financial information. This feature is particularly valuable in dynamic business environments.

3. Configuration

FlashSpread allows users to configure their P&L statements to meet their specific needs. This flexibility ensures that decision-makers have access to the information that matters most to their organization.

4. Collaboration

Collaboration is made seamless with FlashSpread. Multiple team members can work on the same P&L statement simultaneously, facilitating efficient teamwork and decision-making.

5. Security

FlashSpread prioritizes data security, ensuring that sensitive financial information remains confidential and protected from unauthorized access.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The Benefits of Using FlashSpread

1.Time Efficiency

FlashSpread reduces the time required for P&L analysis, allowing decision-makers to focus on strategic planning rather than data entry and manipulation.

2. Data Accuracy

Automation minimizes the risk of human errors, ensuring that the financial data used for decision-making is precise and reliable.

3. Enhanced Decision-Making

FlashSpread’s interactive features provide decision-makers with valuable insights, enabling them to make well-informed choices that drive profitability.

4. Scalability

As businesses grow, FlashSpread can easily scale to accommodate increasing volumes of financial data, making it a valuable long-term solution.

5. Cost Savings

By automating manual tasks and reducing errors, FlashSpread helps organizations save money in the long run, as it mitigates the potential financial losses associated with poor decision-making.

Case Study: A Real-World Example

To illustrate the effectiveness of FlashSpread, let’s consider a real-world example. Imagine a retail company that operates several stores across the country. Traditionally, their finance team would spend hours manually inputting data from each store’s P&L statement into a spreadsheet for analysis. This time-consuming process often led to errors and delayed decision-making.

Upon implementing FlashSpread, the company experienced significant improvements:

1. Time Saved

The automation of data import and real-time updates reduced the time spent on P&L analysis.

2. Error Reduction

With automated data input, errors in financial statements virtually disappeared, enhancing the accuracy of decision-making.

3. Data Visualization

The interactive dashboards allowed the finance team to create visual representations of P&L data, making it easier for decision-makers to identify trends and opportunities.

4. Faster Decision-Making

Armed with timely and accurate information, the company’s executives could make decisions more rapidly, leading to improved business agility.

FlashSpread stands out as a game-changer for P&L analysis. By automating data processes, offering real-time updates and providing configurable, interactive dashboards, it empowers decision-makers to make informed choices with confidence.

In today’s fast-paced business world, where data accuracy and speed are paramount, FlashSpread is a vital tool for organizations looking to enhance their financial decision-making processes and maximize profitability.

The integration of FinTech solutions like FlashSpread represents a significant step toward a more efficient and effective financial industry. As technology continues to advance, we can expect further innovations that will revolutionize the way we analyze financial data, ultimately leading to smarter and more profitable decisions for businesses worldwide.

Embracing FinTech tools like FlashSpread is not just a competitive advantage; it’s a necessity in the modern financial landscape. Contact us today to explore how FlashSpread can optimize your business.