In today’s rapidly evolving business landscape, the efficient management of financial data is more critical than ever. Accurate and timely balance sheet reporting is the bedrock of financial stability and informed decision-making for organizations of all sizes. As the financial world embraces the digital age, the role of financial technology (fintech) has become increasingly prominent.

In this blog post, we will explore how FlashSpread, a cutting-edge fintech solution, is revolutionizing the way organizations handle balance sheet reporting.

Table of Contents

The Significance of Balance Sheet Reporting

Balance sheet reporting has transcended its traditional role and evolved into a strategic asset for organizations. This section will highlight the pivotal importance of balance sheet reporting.

1. Enhancing Transparency

Today, transparency is paramount. Balance sheet reporting serves as a tool for organizations to convey their financial health to stakeholders, investors and regulatory bodies.

Fintech has empowered organizations to maintain accurate and real-time financial records, ensuring compliance with ever-evolving financial regulations.

2. Boosting Investor Confidence

Investors demand transparency and reliability. Accurate balance sheet reporting, aided by fintech, bolsters investor confidence by providing them with the insights they need to make informed decisions.

3. Facilitating Strategic Decision-Making

Modern businesses operate in a dynamic environment. Fintech enables organizations to access real-time financial data, enabling swift and informed decision-making, a crucial aspect of strategic planning.

Challenges in Traditional Balance Sheet Reporting

While balance sheet reporting has evolved, traditional methods still pose significant challenges. In this section, we’ll explore these challenges and discuss how fintechis the key to overcoming them.

1. Automating Data Entry

Traditional reporting often involves manual data entry, a labor-intensive and error-prone process. Fintech solutions like FlashSpread automate this process, reducing errors and freeing up resources.

2. Enhancing Collaboration and Version Control

Collaboration on financial reports can lead to version control nightmares, making it difficult to track changes accurately. Fintech platforms like FlashSpread facilitate real-time collaboration, ensuring everyone works on the latest version of the report.

3. Streamlining Data Reconciliation

Reconciling data from various sources and spreadsheets can be time-consuming and prone to errors. Fintech tools streamline this process, saving time and minimizing discrepancies.

4. Gathering Real-Time Insights

Traditional methods often fail to provide real-time updates, hampering the ability to make timely decisions. Fintechsolutions like FlashSpread offer real-time access to financial data, empowering organizations to stay agile.

A Fintech Solution Transforming Balance Sheet Reporting

In this section, we’ll explore how FlashSpread, a fintech solution, revolutionizes balance sheet reporting for commercial lenders.

1. Automation

FlashSpread harnesses the capabilities of Financial Technology to automate data entry, reducing the risk of manual errors and allowing financial professionals to focus on analysis.

2. The Real-Time Advantage

FlashSpread provides real-time updates, ensuring that financial professionals have access to the most current information. This feature revolutionizes decision-making in today’s fast-paced business world.

3. Collaboration Made Easy

FlashSpread’s collaboration features leverage Financial Technology to create a seamless workflow, eliminating version control issues and promoting efficiency.

4. Efficient Data Integration

FlashSpread seamlessly integrates with various financial systems and data sources, simplifying the consolidation of data from multiple origins.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

5. Compliance and Standardization

FlashSpread offers standardized templates and follows reporting standards, ensuring that reports are not only accurate but also compliant with regulatory requirements.

Key Features of FlashSpread Enhanced by Financial Technology

Let’s explore the key features of FlashSpread that are revolutionizing balance sheet reporting, all thanks to the integration of Fintech:

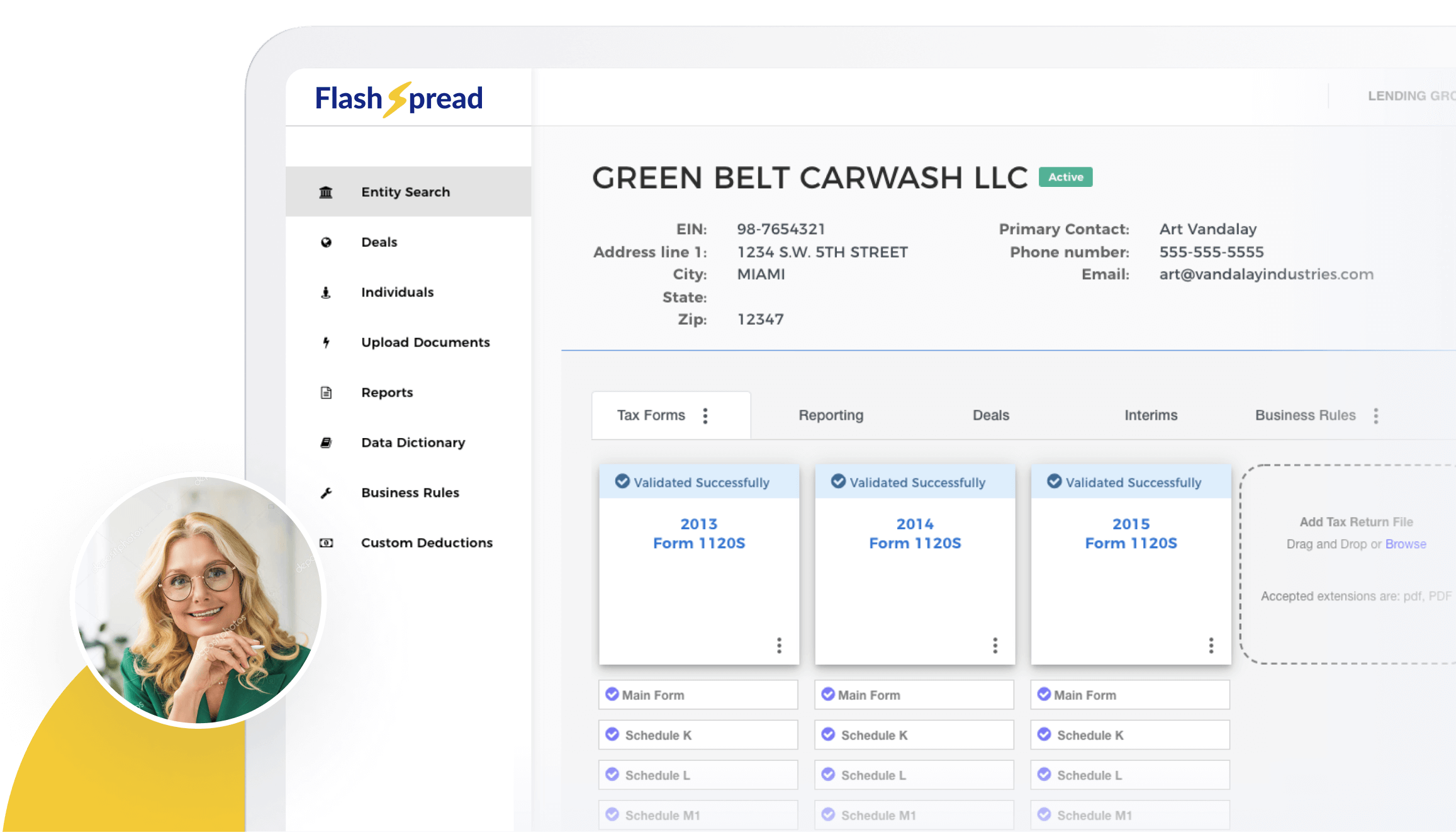

User-Friendly Interfaces

FlashSpread boasts an intuitive user interface requiring minimal training and enabling financial professionals to navigate the platform with ease.

Error Reduction

The platform includes robust data validation checks to identify and flag inconsistencies or errors, bolstering the accuracy of reports.

Configurable Reports

While offering standardized templates, FlashSpread allow configuration, meeting the unique reporting needs of different organizations.

Transparency

FlashSpread’s meticulous audit trail, tracks all changes made to a report, enhancing transparency and supporting compliance efforts.

Security Assurance

With financial data being sensitive, FlashSpread, prioritizes security to ensure data remains protected against unauthorized access.

The Impact of Financial Technology

Embracing FlashSpread offers a multitude of advantages for organizations, underscoring the profound impact of Fintech:

1. Efficiency Amplified

Automation and real-time updates, translate into substantial time savings, allowing financial professionals to allocate their efforts more strategically.

2. Error Reduction

The platform’s data validation and error-checking features minimize the risk of reporting errors, enhancing the reliability of financial data.

3. Real-Time Empowerment

Real-time access to financial data empowers decision-makers with timely, precise information, fostering swifter and more informed choices.

4. Efficiency

The streamlined reporting process enabled by FlashSpread often leads to cost savings, stemming from reduced labor hours and heightened operational efficiency.

5. Compliance Assurance

FlashSpread, supports organizations in maintaining compliance with financial reporting regulations, mitigating the potential risk of regulatory penalties.

Empowering Organizations through Financial Technology

In the ever-evolving landscape of technology, FlashSpread stands as a testament to the transformative power of innovation. Its automation, real-time updates and collaborative capabilities usher in a new era of efficiency and accuracy in balance sheet reporting.

As organizations navigate the complexities of financial reporting, FinTech solutions like FlashSpread will continue to play an increasingly pivotal role, enabling them to make informed decisions, maintain transparency and thrive in an ever-changing business environment.

Ready to supercharge your balance sheet reporting with the power of Financial Technology? Contact FlashSpread today to embark on a journey towards unparalleled success!