Discover how fintech advancements have streamlined loan processes while CDCs/CDFIs play a crucial role in supporting underserved communities. Learn how the 504 loan program facilitates access to affordable capital for small businesses, bridging the lending gap with personalized guidance and community-focused support.

The landscape of commercial lending has witnessed significant transformations with the advent of technology. Fintech innovations have not only streamlined loan application processes but have also increased accessibility for small businesses seeking capital.

While technology has made lending more efficient, it is important not to overlook the crucial role of Community Development Corporations (CDCs) and Community Development Financial Institutions (CDFIs) in supporting economic growth. In particular, the 504 loan program has been instrumental in facilitating commercial lending to small businesses. This article explores the intersection of commercial lending technology and the involvement of CDCs/CDFIs in the 504 loan program.

Table of Contents

Commercial Lending Technology Advancements

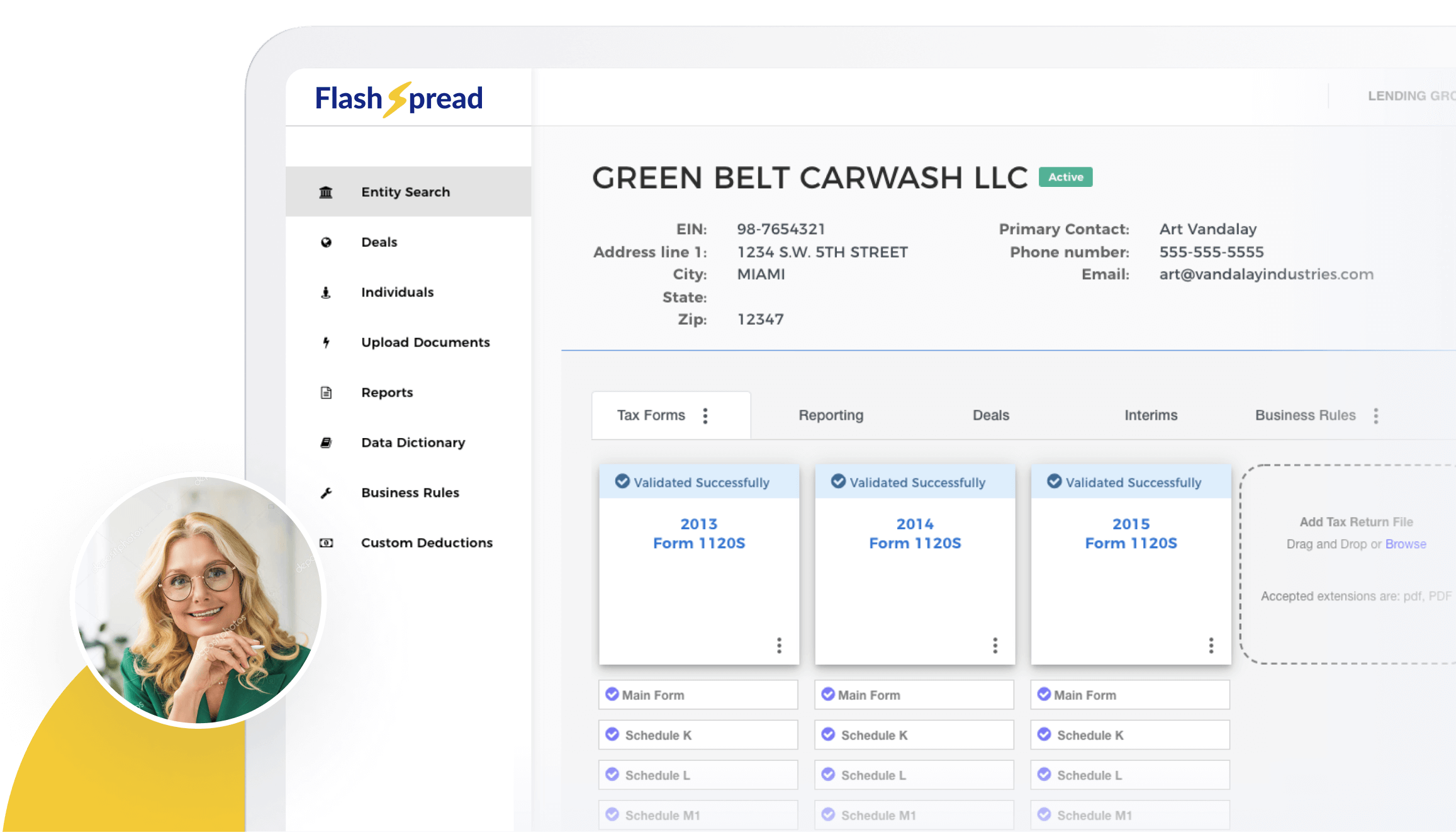

In recent years, the application of technology in commercial lending has revolutionized the borrowing experience. Online platforms have emerged that connect borrowers with lenders, simplifying the loan application and approval process.

These platforms leverage advanced algorithms and data analytics to assess creditworthiness and determine loan eligibility quickly and accurately. Automation of loan documentation, underwriting, and loan servicing tasks has significantly reduced processing times and administrative burdens.

Moreover, the rise of alternative data sources, such as business performance metrics and social media data, has enabled lenders to make more informed lending decisions for small businesses lacking traditional credit history.

This has opened up opportunities for entrepreneurs who were previously overlooked by traditional financial institutions. Additionally, digital platforms have facilitated peer-to-peer lending, allowing individual investors to participate in commercial lending and diversify their investment portfolios.

The Role of CDCs/CDFIs in Commercial Lending

While technology has undoubtedly improved the efficiency of commercial lending, the importance of CDCs and CDFIs in supporting underserved communities cannot be overstated.

CDCs are nonprofit organizations that aim to revitalize and promote economic growth in specific geographical areas, typically low-income communities. CDFIs, on the other hand, are specialized financial institutions that provide financial services to individuals and businesses in underserved markets.

Both CDCs and CDFIs play a critical role in bridging the lending gap for small businesses that may not qualify for traditional loans.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The 504 Loan Program

The 504 loan program, administered by the U.S. Small Business Administration (SBA), is a notable example of the partnership between CDCs/CDFIs and technology in commercial lending.

This program provides long-term, fixed-rate financing for small businesses to acquire major fixed assets, such as land, buildings and equipment. It enables small businesses to access affordable capital with lower down payment requirements and longer repayment terms.

CDCs, certified by the SBA, act as intermediaries between borrowers and lenders in the 504 loan program. They work closely with small businesses, helping them navigate the loan application process, prepare the necessary paperwork and connect them with approved lenders.

The involvement of CDCs adds an important layer of personalized guidance and support to small business owners who may be unfamiliar with the loan application process.

Furthermore, CDCs are responsible for administering the funds disbursed through the 504 loan program, ensuring that they are used appropriately and contributing to the economic development of the community. This oversight helps to mitigate risk and ensure the long-term success of the program.

Roundup

As technology continues to reshape the commercial lending landscape, CDCs/CDFIs and the 504 loan program remain vital in supporting the growth and development of small businesses.

While fintech innovations have improved accessibility and efficiency, the expertise and community-focused approach of CDCs and CDFIs are essential in providing targeted support to underserved communities.

The 504 loan program exemplifies the successful collaboration between technology and community development institutions, ensuring that small businesses have access to the capital they need to thrive and contribute to local economies.

Contact our experts today to learn more about our technology and the 504 Loan Program!