In today’s fast-paced lending industry, providing a seamless and efficient borrowing experience is paramount for lenders. A critical step in this process is issuing pre-qualification letters to potential borrowers. However, the lack of configurable options often results in generic and impersonal letters that fail to reflect borrowers’ financial positions and potential accurately.

At BeSmartee, we understand the importance of personalization, so we are thrilled to introduce our latest feature: Configurable Pre-Qualification Letters. With this new functionality, lenders can craft personalized and professional documents that cater to the unique needs of each borrower, streamlining the lending process and fostering a more engaging borrower experience.

Imagine a borrower receiving a pre-qualification letter tailored explicitly for them, showcasing not just their loan details but also their lender’s branding and contact information. Such a letter makes a powerful first impression and instills confidence in borrowers. Today, we delve into the game-changing feature transforming the lending landscape, enabling lenders to create fully configurable pre-qualification letters in just a few clicks.

Before the advent of this new feature, lenders faced numerous challenges in personalizing pre-qualification letters. Each time a new client was onboarded with BeSmartee, developers had to invest considerable time and effort in hardcoding the letter for the lender.

This manual process consumed valuable resources and delayed the delivery of essential borrower documents. However, with our Configurable Pre-Qualification Letter feature, lenders have complete control over their letters, ensuring they align with their branding and cater to borrowers’ needs.

According to a recent study by the PEW , borrowers prioritize lenders who provide a personalized borrowing experience. Additionally, more than 80% of borrowers are likely to choose a lender that offers a streamlined and efficient application process.

Our Configurable Pre-Qualification Letters directly address these demands, fostering a competitive edge for lenders and increasing borrower satisfaction. This feature also empowers lenders to stay ahead of the curve by creating personalized and professional documents that resonate with borrowers. Let’s explore how this feature works and its benefits to lenders and borrowers.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Designing Your Personalized Pre-Qualification Letter for Lending

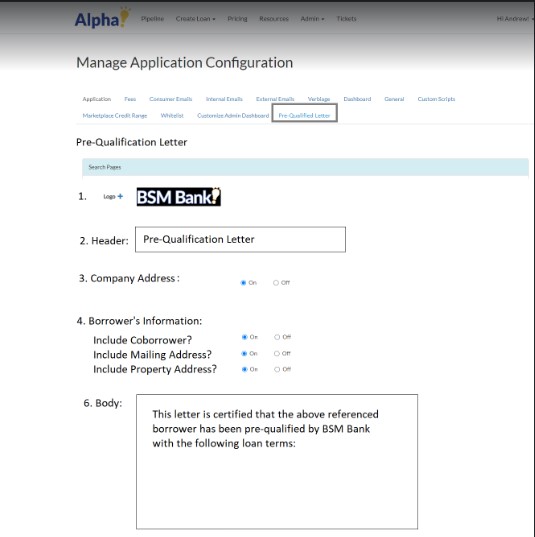

In this section, we guide lenders through configuring their pre-qualification letters. Under the Admin/Configuration section, a new Pre-Qualification Letter Template is added, allowing lenders to make various adjustments:

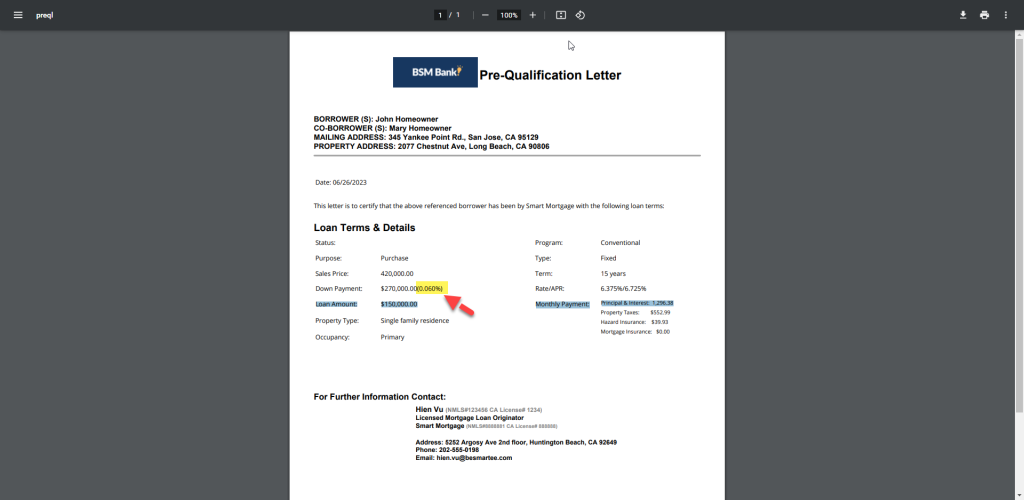

- Uploading the Company Logo: Lenders can add their company’s logo to the letter, enhancing brand visibility and reinforcing borrower trust. The logo is perfectly positioned on the top of the letter, making a striking visual impact.

- Personalizing the Header: Lenders can tailor the letter’s header to include their company’s name, address, and contact information. This ensures borrowers know whom to reach out to for any queries.

- Updating Borrower and Co-Borrower Information: Our Configurable Pre-Qualification Letters fetch essential details directly from the borrower’s application, such as their names, mailing addresses, and property address. This automation eliminates the need for manual data entry, saving valuable time for both lenders and borrowers.

- Incorporating Loan Details: From loan purpose and sales price to down payment, loan amount, and loan type, lenders can effortlessly include all relevant loan details in the letter. The information is pulled from the application’s transaction and property tabs, ensuring accuracy and consistency.

- Showcasing Loan Officer Information: Lenders can proudly display their loan officers’ details, including names, NMLS numbers, phone numbers and email addresses. This personal touch establishes a direct line of communication between borrowers and loan officers, fostering trust and accessibility.

Enhancing the Lending Experience

By offering fully configurable pre-qualification letters, BeSmartee significantly enhances the borrowing experience for both lenders and borrowers. Some of the key benefits include:

- Improved Branding: Configured Pre-Qualification Letters feature the lender’s logo, header, and contact information, reinforcing brand identity and credibility. Borrowers are more likely to remember and trust lenders with a professional and consistent image.

- Time and Cost Savings: Eliminating the need for manual coding saves developers’ time and reduces operational costs. Lenders can now generate personalized letters instantly, expediting the lending process.

- Engaged Borrowers: Personalized letters resonate with borrowers, making them feel valued and understood. This positive experience encourages borrower loyalty and referrals.

- Compliance and Accuracy: Configurable Pre-Qualification Letters ensure accuracy and compliance with lending regulations by fetching information directly from the application.

Brand New Lending Technology Feature: Configurable Pre-Qualification Letters

Looking Ahead – Embracing a Personalized Future

In a rapidly evolving lending landscape, personalization is no longer an option but a necessity. The Configurable Pre-Qualification Letter feature from BeSmartee empowers lenders to take the lead in delivering exceptional borrower experiences. Lenders can cultivate meaningful relationships with borrowers by leveraging this innovative tool, driving business growth and success.

In conclusion, our Configurable Pre-Qualification Letters feature marks a significant milestone in the lending industry. This new feature equips lenders with the tools they need to create personalized and professional documents that resonate with borrowers. With improved branding, time savings and enhanced borrower engagement, BeSmartee’s Configurable Pre-Qualification Letters are set to revolutionize the lending process for lenders and borrowers alike.

Are you ready to embrace the power of personalization and transform your lending experience with BeSmartee’s Configurable Pre-Qualification Letters? Start delivering exceptional borrower experiences and contact our mortgage technology experts today.