Discover how BeSmartee’s Soft-Pull Logic feature elevates the lending process by empowering lenders to offer worry-free credit score checks, while protecting borrowers’ credit history and providing peace of mind.

As a lender, you understand the importance of providing your borrowers with a seamless and worry-free experience when it comes to checking their credit scores. After all, informed borrowers make better decisions about their lending options. That’s why BeSmartee‘s Mortgage Point-of-Sale (POS) solution introduces the Soft-Pull Logic feature, designed to give borrowers peace of mind while exploring their lending options.

How It Works

In the lending process, borrowers often need to check their credit scores to gauge their financial standing and make informed decisions about which loans to pursue. Traditionally, this involved a hard-pull credit inquiry, which could negatively impact a borrower’s credit history. However, with BeSmartee’s Soft-Pull Logic, borrowers can now check their credit scores without the fear of harming their credit history. Let’s delve into how this feature works and the benefits it offers.

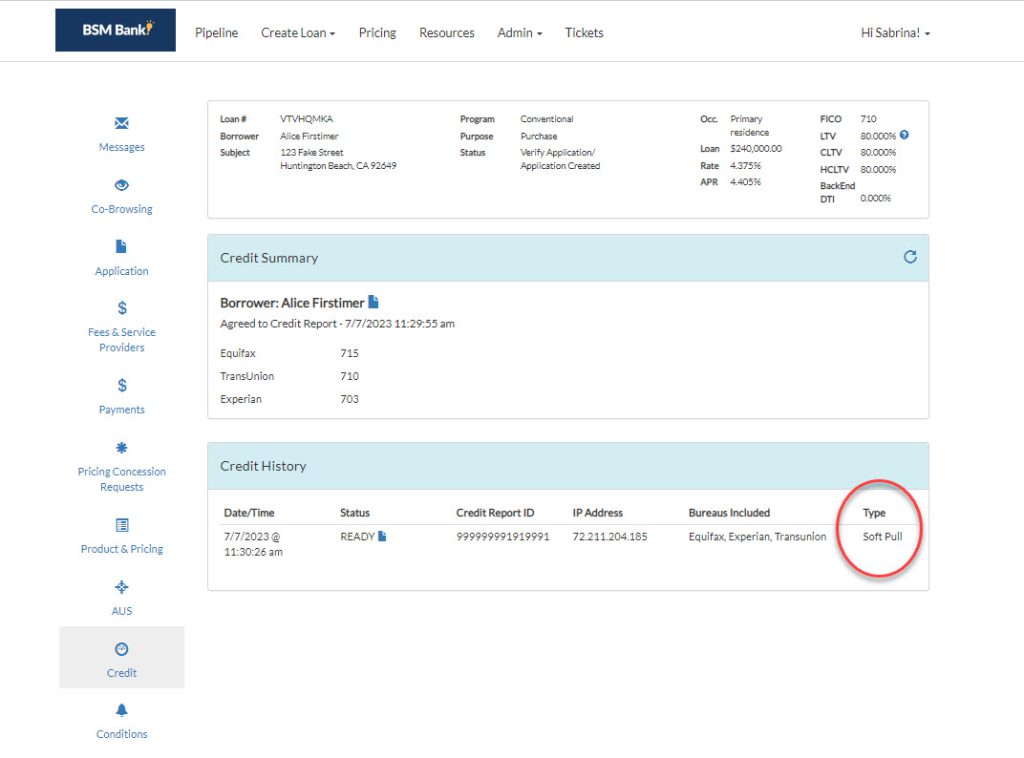

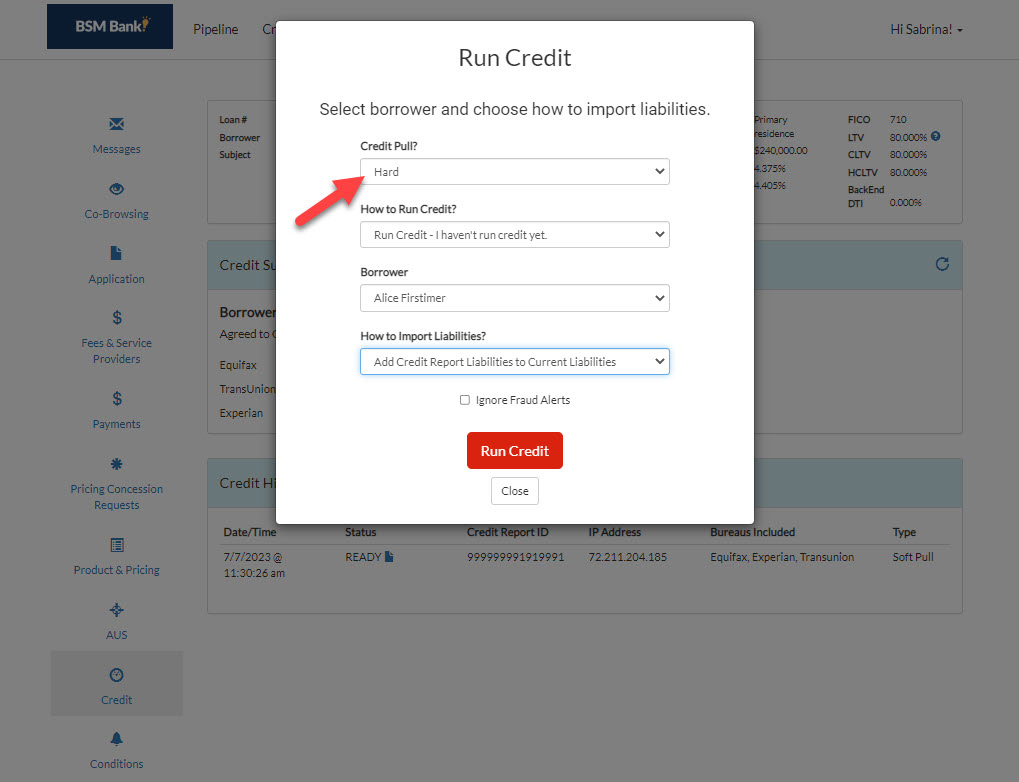

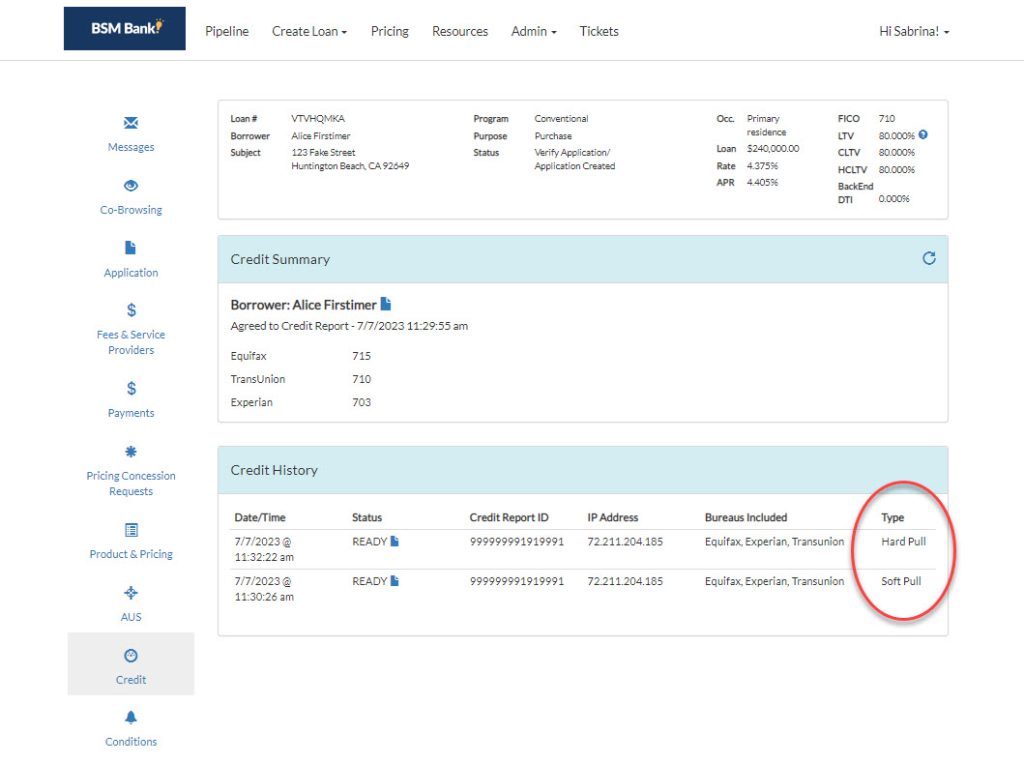

Performing a Soft-Pull Credit Check

When borrowers engage with your Mortgage POS solution, they can access the Soft-Pull Logic feature. By simply clicking on the “Run Credit” button, a modal appears, allowing borrowers to choose between a hard-pull or a soft-pull credit check. The default option is set to the value of the Default Credit Pull at the loan level. By selecting the soft-pull option, borrowers can explore their lending options freely, knowing that their credit history remains unharmed.

The Advantages of Soft-Pull Credit Checks

So, what exactly is a soft-pull credit check? Unlike a hard-pull inquiry, a soft-pull credit check does not impact a borrower’s credit history. It allows borrowers to view their credit scores for informational purposes without any adverse consequences. With BeSmartee’s BSM Soft-Pull Logic, borrowers gain the confidence to shop around for the best loan offers and lenders without the fear of damaging their creditworthiness.

Key Features

Support for All Credit Reporting Agencies

One of the key advantages of BeSmartee’s Soft-Pull Logic is its support for all Credit Reporting Agencies (CRA) globally. Regardless of the CRA you rely on, our solution seamlessly integrates soft-pull credit checks. Whether you use the Credit Soft-Pull + DU Early Assessment logic or any other CRA-specific logic, our system has you covered.

Flexible Implementation Options

Moreover, the soft-pull and hard-pull options can be applied at various levels within your organization, such as the campaign level, branch level, or even at the company level through our intuitive user interface. The Credit setting determines whether a hard-pull or soft-pull is performed, with the default option set to hard-pull. This flexibility allows you to tailor the credit check process to your specific needs while providing borrowers with a seamless experience.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

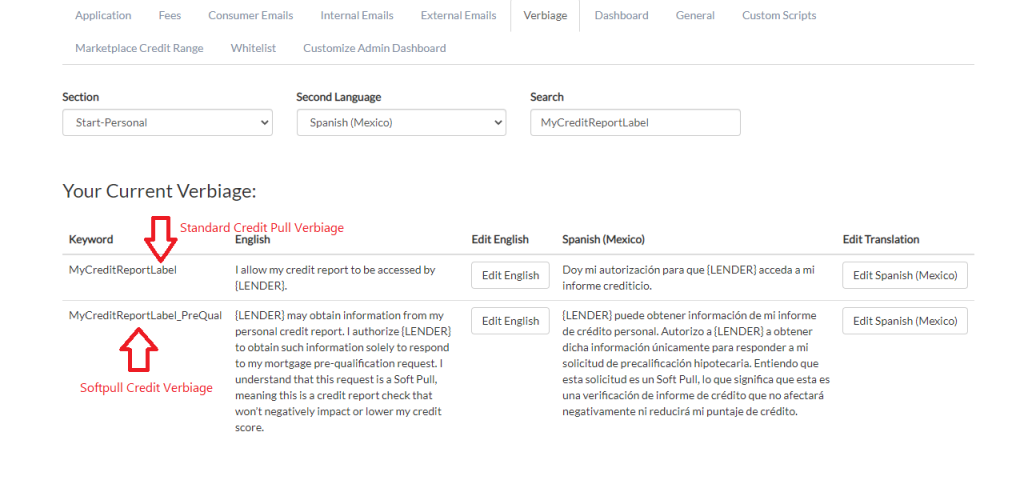

Clear Distinction and Consent

When it comes to the loan application process, BeSmartee’s Soft-Pull Logic ensures a clear distinction between consent for soft-credit pulls and hard-credit pulls. Borrowers are presented with different consent options based on the type of credit check being performed. This enables borrowers to make informed decisions and provide consent accordingly, enhancing transparency and building trust.

Enhanced Borrowing Experience

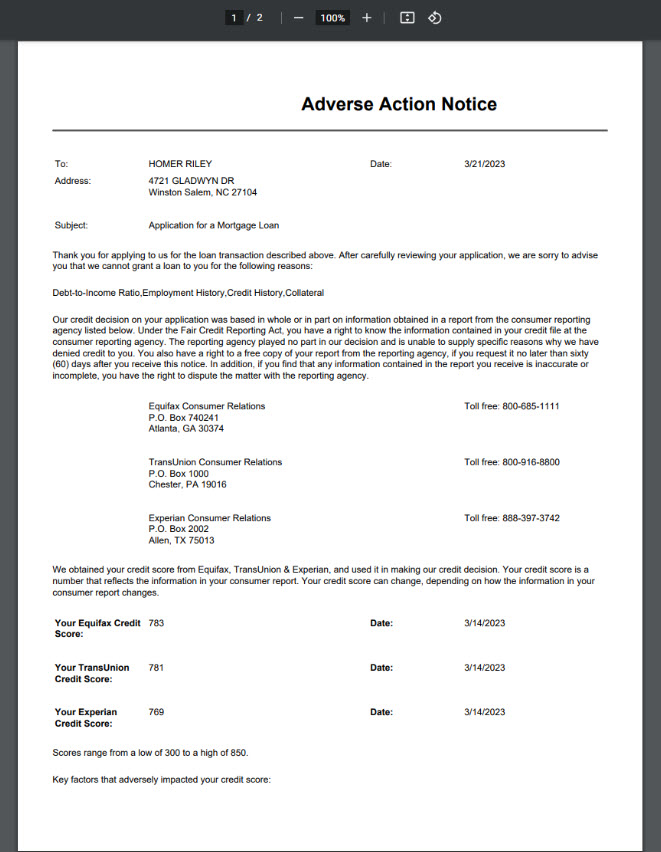

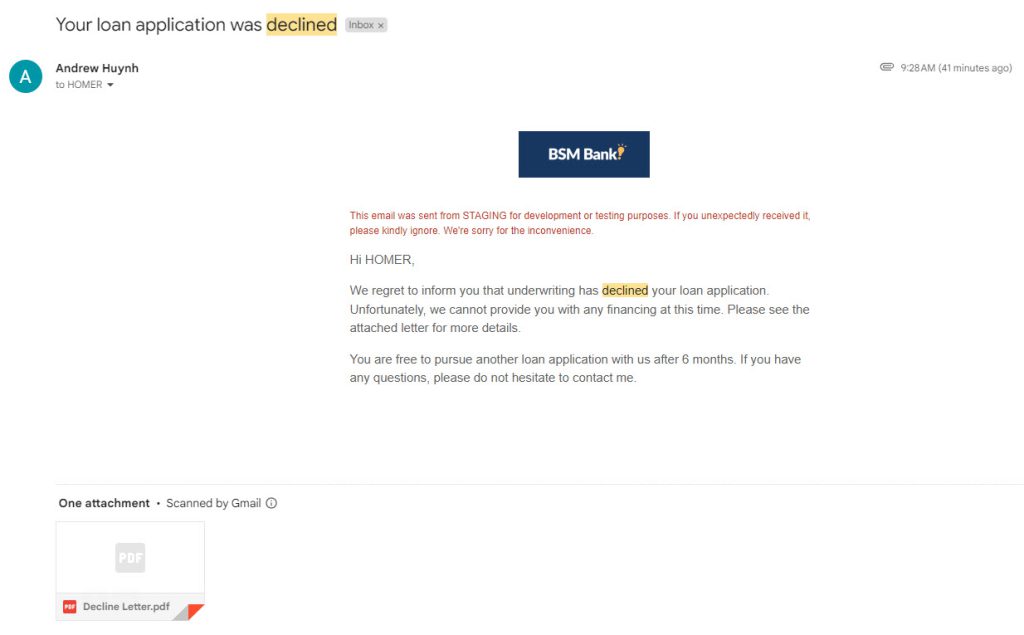

Adverse Action Letter Generation

Let’s address a scenario where a borrower’s loan application is denied after a soft-pull credit check. With BeSmartee’s Soft-Pull Logic, the adverse action letter/email will not be generated in such cases. However, if the loan transitions from a soft-pull to a hard-pull, the adverse action letter will be generated. Our system automatically checks if any hard-pulls have been made on the loan, and if the count is equal to or greater than one, the adverse action letter will be generated.

Seamless Implementation Process

Credentials Cascade

BeSmartee’s Soft-Pull Logic ensures a smooth implementation process for lenders. Credentials cascade based on the following levels: Campaign → Processor → Loan Officer (LO) → Branch → Lender. This hierarchical approach guarantees that the appropriate access is granted to perform the desired credit checks, maintaining security and control throughout the process.

URL Endpoints

It’s important to note that specific URL endpoints for each CRA are currently hard-coded within BeSmartee’s system. This means that you can seamlessly leverage the Soft-Pull Logic feature without the need to configure individual endpoints for different Credit Reporting Agencies. We take care of the technical aspects so that you can focus on providing an exceptional borrowing experience.

Conclusion

In conclusion, BeSmartee’s Soft-Pull Logic is a game-changer for lenders, empowering borrowers to explore their lending options without worrying about harming their credit history. By offering soft-pull credit checks, you give borrowers the peace of mind they need to make informed decisions. With support for all Credit Reporting Agencies, flexible implementation options, and a clear distinction between soft-pull and hard-pull credit checks, BeSmartee’s Soft-Pull Logic is the solution you need to elevate your lending process.

Provide your borrowers with a seamless and worry-free experience by implementing BeSmartee’s Soft-Pull Logic. Empower them to find out their lending options without compromising their credit history. Now, you can start giving your borrowers the peace of mind they deserve today.