According to recent mortgage research from Moody’s Analytics, loan officers face numerous challenges when processing applications. The process often involves starting from scratch when moving from a pre-qualification application to a full application, leading to time-consuming manual tasks and potential data discrepancies.

But what if there was a way to simplify this process and seamlessly transition qualified applicants from pre-qualification to full application? Enter the revolutionary “Upgrade Application” feature, designed to streamline the lending process and save time for both loan officers and applicants. Let’s dive into this game-changing enhancement and explore how it works.

Imagine you’ve spent hours assisting a potential homebuyer with their pre-qualification application, only to find out they are now ready for a full application. The thought of starting the entire process from scratch can be daunting.

With the Upgrade Application feature, such concerns are a thing of the past. This new tool empowers loan officers to effortlessly upgrade pre-qualification applications, ensuring a smooth transition and a hassle-free experience for applicants. Let’s explore the benefits and functionality of this exciting addition to the lending process.

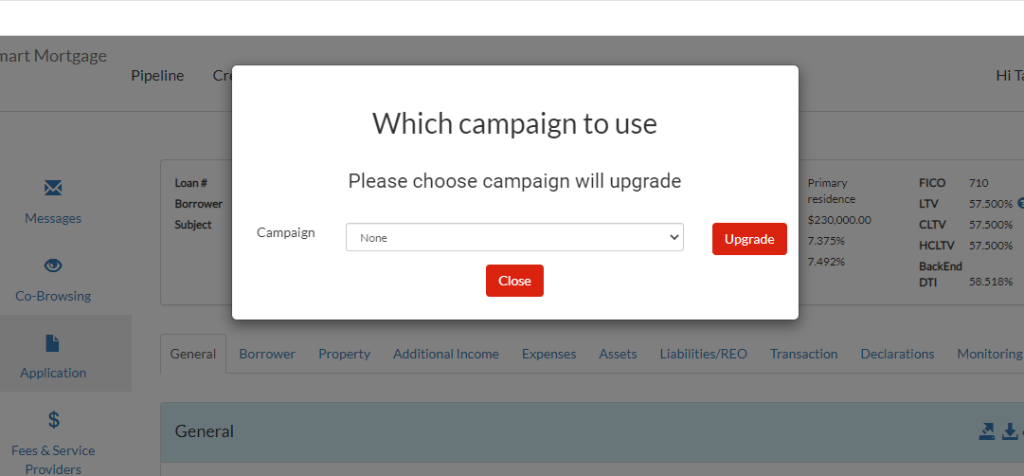

Before we delve into the specifics of the “Upgrade Application” feature, let’s first understand the manual process of upgrading a pre-qualification to a full application. The current process requires loan officers to set the campaign from “Pre-Qualification” to a “Non Pre-Qualification” campaign. Additionally, they must re-pull credit, run the pricing engine, and fill in missing borrower information, among other tasks.

While this process has been the norm, it is time-consuming and prone to errors. Let’s see how the “Upgrade Application” feature simplifies and automates these steps, making the loan officer’s life much easier.

The “Upgrade Application” feature represents a significant leap forward in the digital mortgage world. It addresses the pain points associated with manual upgrades and streamlines the entire process, enabling loan officers to focus on serving their customers better. By providing seamless access and transfer of information from pre-qualification to full application, this feature is set to continue supporting the mortgage industry.

What is the Upgrade Application Feature?

The “Upgrade Application” feature is a tool designed to enhance the lending process for loan officers. This feature appears under the application general tab as an “Upgrade Application” button when the loan application type is “Pre-Qualification.” A distinctive icon for easy identification accompanies the button. When loan officers hover over the button, a helpful tooltip guides them on its functionality.

How Does That Work in the Mortgage Industry?

When loan officers click the “Upgrade Application” button, they are prompted to choose between a soft pull or a hard pull for the new application. This selection ensures flexibility and aligns with the lender’s preferences. After this choice, the application’s “appType ” is automatically upgraded to the highest available option for that specific lender, such as Application, ShortAUS, or Full application.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The loan status is reset to “Start-Search,” providing a clean slate for the upgraded application process. As the borrower progresses through the application, the feature pulls credit information from the chosen credentials (soft pull or hard pull) based on the previous selection.

This eliminates manual credit pulls and ensures accurate and up-to-date credit information.

Furthermore, the “Upgrade Application” feature reruns the pricing engine (PPE). It resubmits the application to the Automated Underwriting System (AUS) using the same case number as the DU Early Assessment Run. This guarantees consistency and minimizes delays in the approval process.

BeSmartee Introduces the Loan Application Upgrade Feature to Continue Supporting Digital Mortgage

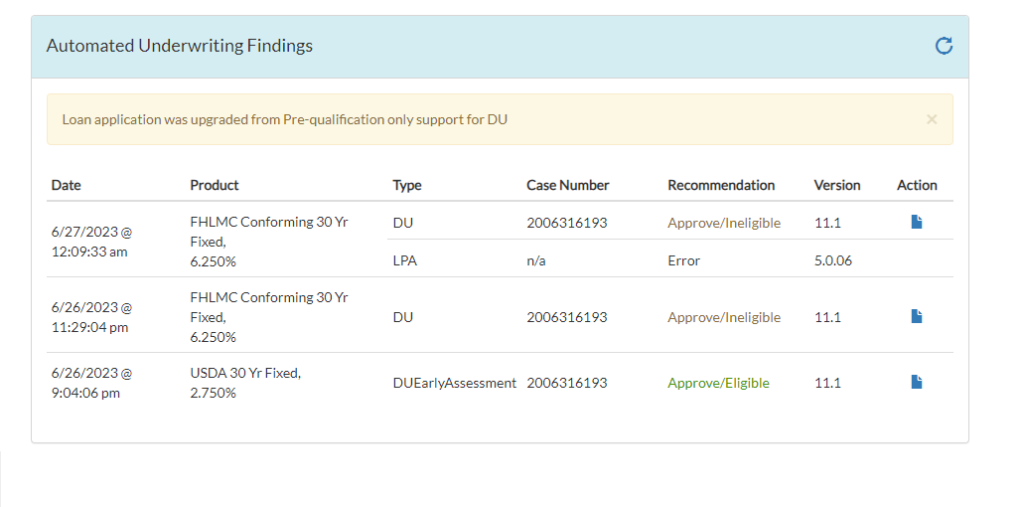

Dual AUS Warning

In cases where the lender uses dual AUS (e.g., DU + LPA) and the loan is converted from pre-qualification, a warning message is displayed above the Automated Underwriting Findings table. The notification alerts the loan officer that the loan application was upgraded from pre-qualification and that support is available only for DU. This transparent communication ensures that loan officers are well-informed and can proceed accordingly.

The “Upgrade Application” feature empowers loan officers to seamlessly transition applicants from pre-qualification to complete applications, saving time and effort for both parties involved. Loan officers can now focus on delivering exceptional customer service and expediting the lending journey by eliminating manual tasks and automating key processes.

Incorporating user-friendly features such as tooltips, clear icons and flexible choices for credit pulls, the “Upgrade Application” feature sets a new standard for efficiency and convenience in the mortgage industry. As we move toward a more digitized future, innovations like this will be crucial in transforming how we approach mortgage lending. So, why wait?

Embrace the “Upgrade Application” feature and unlock the potential of a streamlined lending process today. Your customers will thank you, and your loan officers will work with newfound ease and confidence. Experience the future of mortgage technology and witness the difference firsthand!