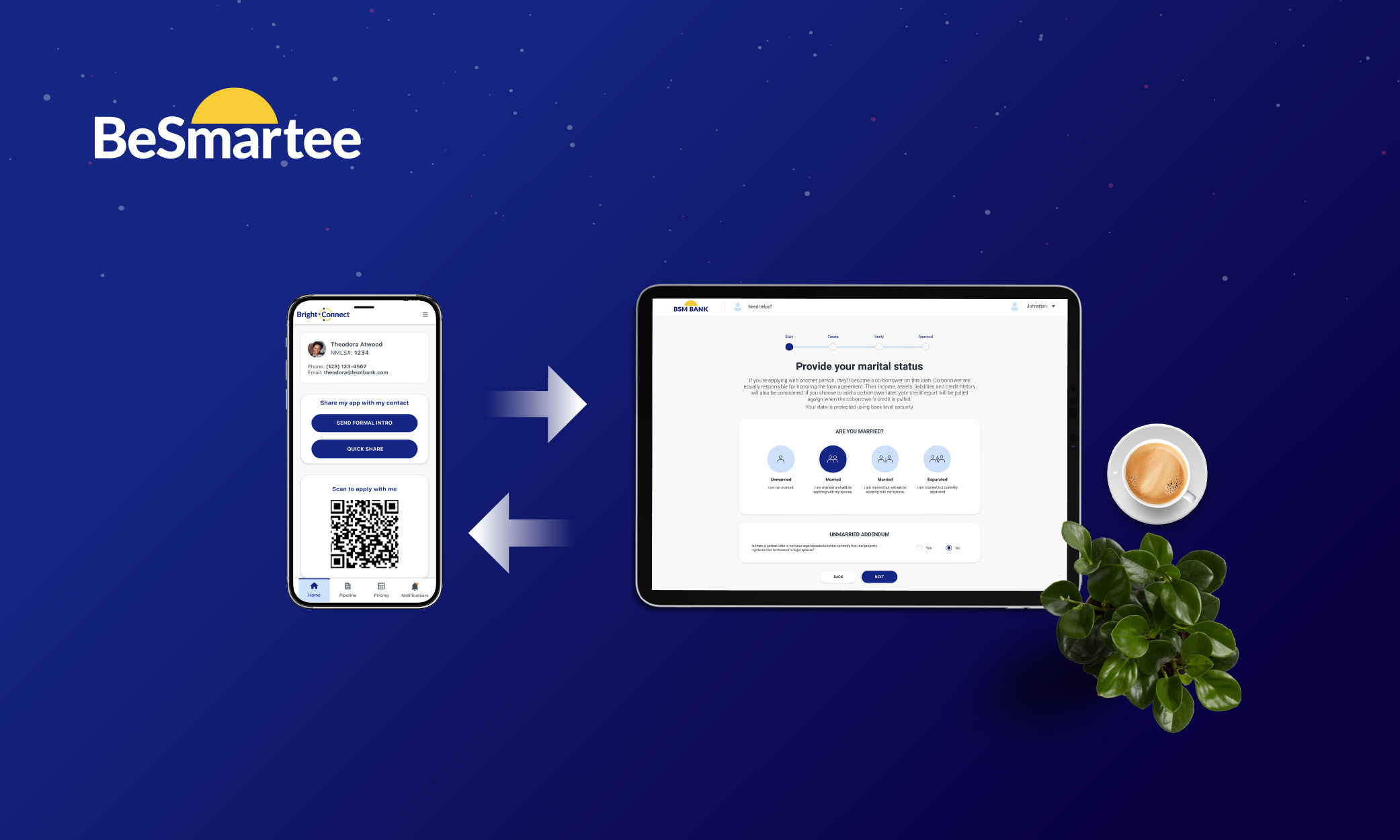

From Application to Approval: Boosting Borrower Conversion Rates Without Adding Work and Cost

Lenders don’t need more hours in the day to improve borrower conversion. Learn how automation, data, and a revenue engine could help turn more applicants into approved borrowers, without adding workload and operational costs.