For years, speeding up SBA loan approvals has been more wishful thinking than reality. Manual financial spreading, scattered documents, and inefficient workflows routinely delayed decisions, forcing borrowers to wait days or even weeks.

This blog explores why speed is becoming the defining competitive edge in SBA lending, where traditional workflows fall short, and how automation can help you hit the new speed standard: turning weeks into hours.

Key Insights at a Glance

- Loan speed is now a deciding factor for borrowers choosing their lender.

- The biggest delays often happen before underwriting even begins.

- Complex borrower structures create bottlenecks in data analysis.

- Automation in financial spreading can cut data prep time from days to minutes.

- Faster loan decisions directly translate into higher borrower satisfaction and lender win rates.

Table of Contents

The Borrower Expectation Shift

Borrowers today expect the same efficiency in SBA lending that they experience in other areas of their financial lives. Real-time banking, instant payments, and immediate credit approvals have set a high bar. Delays are noticeable, frustrating, and, in some cases, costly.

A 2024 Lendio survey found that 85% of small business owners ranked “fast approval” as a critical factor when selecting a lender. This highlights the growing influence of turnaround speed in competitive lending markets. Speed isn’t just about convenience; it can determine whether a borrower captures a business opportunity or misses it entirely.

Traditional loan processes struggle to keep pace. Financial statement spreading is still largely manual in many institutions. Analysts extract figures from tax returns, bank statements, and financial reports, input them into spreadsheets or outdated software, and then perform ratio analyses before decisions can be made.

Each step introduces delays and creates opportunities for human error, slowing approvals and reducing borrower satisfaction. In addition, repeated manual entry can create inconsistencies across files, which further complicates underwriting reviews and adds hidden risk to the process.

Where Bottlenecks Slow the Process

Manual workflows create recurring hurdles that prolong SBA loan approvals. Lenders often face challenges such as:

- Inconsistent document formats: PDFs, scans, and handwritten statements require significant standardization efforts before they can be analyzed.

- Manual data entry: Typing figures into spreadsheets or loan origination systems introduces errors and slows the overall workflow.

- Complex borrower structures: Multi-entity borrowers require consolidation across balance sheets, P&Ls, and cash flow statements—often a time-consuming manual process.

- Spreadsheet overload: Multiple sheets, versions, and formulas create confusion, increase risk of mistakes, and lengthen turnaround times.

These bottlenecks do more than slow down underwriting. They create stress for analysts, increase operational costs, and leave lenders less responsive to borrower needs. Identifying and addressing these pain points is essential for lenders looking to gain a measurable advantage in speed and efficiency.

Why Speed is a Strategic Advantage

Lenders that can process SBA loans faster are better positioned to win business. Fast approvals align with borrower expectations and help prevent opportunities from going to competitors who can move more quickly.

Quick turnaround times also strengthen relationships with brokers, accountants, and referral networks. When partners know that a lender consistently acts efficiently, it increases trust, repeat business, and referrals.

Eliminating repetitive manual work allows underwriting teams to focus on higher-value activities. Analysts can dedicate more attention to evaluating credit risk, identifying growth potential, and making informed judgment calls rather than spending hours on data entry. In addition, speed enables lenders to adjust pricing, term structures, or offer additional services more responsively, giving them a strategic edge in competitive scenarios.

Faster processing also provides operational agility. Lenders can respond promptly to market changes, adjust to borrower needs, and make more informed decisions under tight timelines. This combination of speed, accuracy, and flexibility is becoming a non-negotiable standard in SBA lending.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Automation: The Game-Changer

Automation has the power to transform the financial spreading process from a slow, error-prone bottleneck into a streamlined, high-velocity workflow. Modern automation tools extract data from tax returns, bank statements, and financial reports, instantly converting it into structured, analyzable formats.

By removing manual data entry, automation dramatically reduces errors. Systems can automatically consolidate multi-entity borrower data, calculate key ratios, and populate spreadsheets or loan origination systems within minutes. This allows underwriting teams to handle more applications in less time without sacrificing accuracy.

Automation also increases transparency and compliance. Every calculation is tracked, creating audit-ready documentation that supports regulatory requirements and internal review. Lenders can monitor workflows, identify inefficiencies, and ensure every step of the credit analysis process is documented and verifiable.

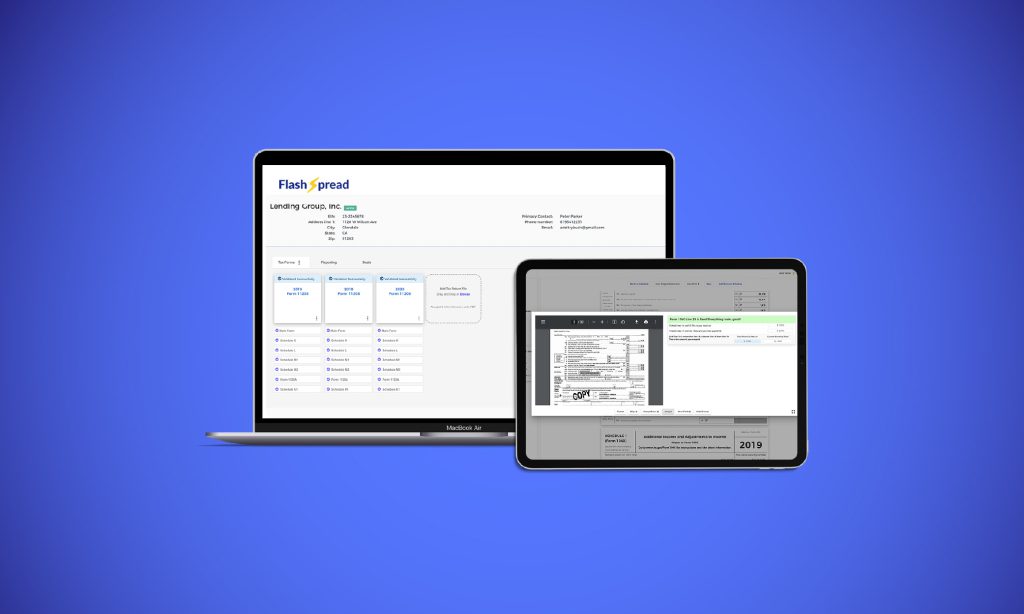

How FlashSpread Delivers the Speed Advantage

FlashSpread, BeSmartee’s automated financial spreading software solution, is designed to tackle the bottlenecks slowing SBA lending. Its OCR-based technology automatically reads and standardizes borrower financial data, reducing hours of manual effort to minutes.

Key benefits include:

- Instant document standardization: PDFs, scans, or paper statements are quickly converted into a uniform format.

- Error reduction: Automated extraction minimizes data entry mistakes, improving decision accuracy.

- Global debt service & monthly monitoring: Automatically calculates global debt service and supports monthly monitoring, enabling faster, data-driven credit assessments.

- Seamless integration: FlashSpread connects with LOS and underwriting systems for immediate data access.

- Scalable efficiency: Teams can process more loans without additional headcount, increasing throughput and productivity.

By addressing these challenges, FlashSpread allows analysts to focus on high-value work, such as credit evaluation and strategic decision-making, while accelerating loan turnaround. Lenders using FlashSpread can make faster, more accurate decisions, improve borrower satisfaction, and increase competitive positioning in the market.

Roundup

SBA lending is evolving, and speed has emerged as a critical competitive differentiator. Borrowers expect quick approvals, and manual financial spreading no longer meets those expectations.

Automation provides a clear solution: faster, more accurate processing that scales with your team. FlashSpread delivers tangible results by standardizing documents, reducing errors, consolidating complex borrower data, and integrating seamlessly with existing systems.

Lenders adopting these technologies gain the speed and agility borrowers demand, positioning themselves to win deals, serve more borrowers, and maintain high satisfaction rates, all without adding staff.

Don’t let manual processes slow you down. Discover how FlashSpread helps your team work faster, smarter, and more accurately