Building trust is a necessity. Borrowers are not only seeking swift approvals but also transparency, control, and consistent communication throughout their home buying journey.

According to the J.D. Power 2024 U.S. Mortgage Origination Satisfaction Study, lenders who actively advise borrowers throughout the lending process achieve significantly higher borrower satisfaction scores. Specifically, the satisfaction score for trust among borrowers who strongly rely on their lender’s expertise is 133 points higher than among those who do not.

This underscores the critical role of trust in the mortgage process. To foster this trust in a digital era, lenders must prioritize transparency, offer intuitive borrower dashboards, and provide real-time updates. These tools not only enhance the borrower experience but also build lasting confidence in the lending relationship.

Table of Contents

Why Trust Matters in the Mortgage Process

Trust is the foundation of any financial relationship, especially in high-stakes decisions like buying a home. Borrowers want to feel confident that their lender is acting in their best interest, providing honest guidance, and safeguarding their personal information. With so many options available today, a lack of trust can quickly drive borrowers to competitors.

Digital tools allow lenders to proactively address common trust barriers, such as lack of clarity, miscommunication, and slow response times. Building trust isn’t just about borrower satisfaction—it also boosts loyalty and improves referrals.

Transparency as a Foundation for Trust

In traditional mortgage lending, much of the process happens behind closed doors. Borrowers submit paperwork and wait for updates, sometimes for days. In contrast, digital mortgage solutions are designed to make every step of the process visible.

Transparency means more than just access. It means lenders clearly explain what’s happening, why it matters, and what the borrower needs to do next. Clear documentation, defined timelines, and upfront disclosures create a shared understanding between the lender and borrower.

When borrowers feel informed, they feel empowered. Transparency eliminates surprises and positions the lender as a reliable partner—one who has nothing to hide.

Borrower Dashboards: Creating Control and Clarity

Borrower dashboards serve as a central hub where borrowers can monitor their application, upload documents, and track progress. Instead of feeling lost in a confusing back-and-forth process, borrowers gain a sense of control.

Dashboards help minimize the friction of traditional paperwork and missed emails. With access to real-time information, borrowers can take action more quickly and understand where their application stands, thus improving satisfaction and reducing unnecessary outreach.

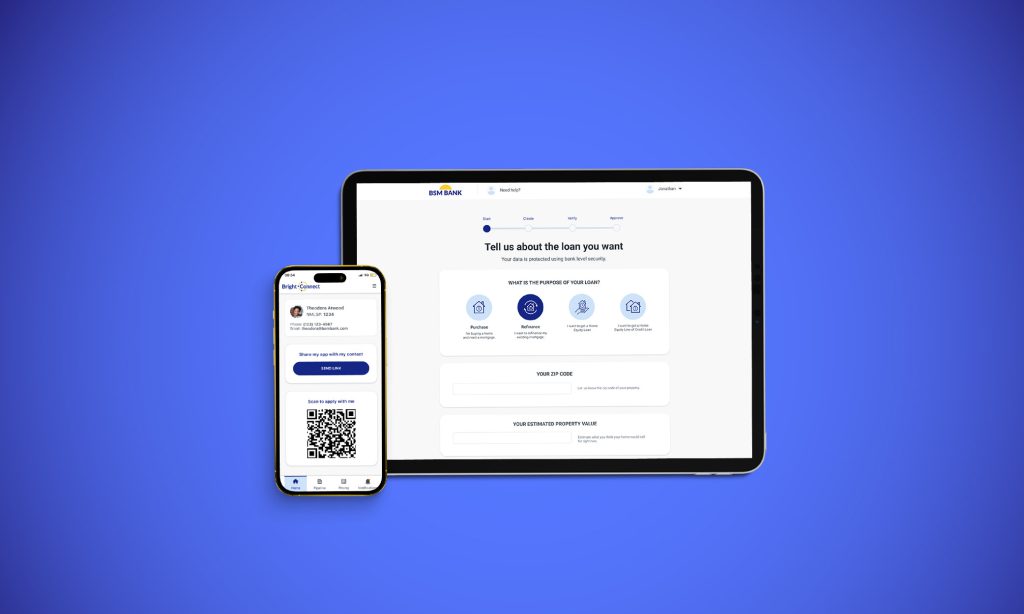

BeSmartee’s Borrower Loan Dashboard enhances this experience by offering a centralized system where borrowers can complete their mortgage applications, upload necessary documents, and monitor their loan status through a single, user-friendly interface.

With features like real-time updates, secure messaging, and integrated document management, the dashboard empowers borrowers to stay informed and engaged throughout the loan process. This level of transparency and accessibility not only reduces uncertainty but also fosters a stronger, trust-based relationship between borrowers and lenders.

How Real-Time Updates Reduce Uncertainty

Few things cause more anxiety in the mortgage process than waiting without answers. Real-time updates solve this by letting borrowers know exactly what’s happening the moment it happens.

Whether it’s a notification that a document has been reviewed, a status change in underwriting, or a rate confirmation, real-time communication eliminates the guessing game. Borrowers stay engaged and reassured because they know they’re not being left in the dark.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

For lenders, this also means fewer follow-up calls and emails. Automated updates improve team efficiency and create a smoother borrower experience without sacrificing quality. Ultimately, real-time visibility transforms the lender-borrower relationship into one built on consistency and accountability.

BeSmartee’s native mobile app, Bright Connect, extends the benefits of real-time updates by delivering instant notifications directly to borrowers’ smartphones. Through Bright Connect, borrowers can receive immediate alerts about document reviews, underwriting status changes, satisfied loan conditions, and when their loan is cleared to close, ensuring they are always informed about their loan progress.

This mobile-first approach not only enhances borrower engagement but also reduces the need for follow-up calls and emails, streamlining communication between borrowers and lenders. By providing real-time visibility into the mortgage process, Bright Connect fosters a more transparent and efficient lending experience.

Combining Technology with Human Support

While technology may feel impersonal at first glance, digital tools actually free up lenders to build stronger human connections. When repetitive tasks like status checks and document requests are automated, mortgage professionals can spend more time advising, educating, and personalizing service.

Modern borrowers appreciate a balance between digital convenience and expert guidance. A well-designed digital experience doesn’t replace the lender, it enhances their ability to support the borrower at key touchpoints.

Evolving Technology: The Shift from Custom to Configurable

As mortgage technology providers evolve to better support these trust-building capabilities, we’re seeing a significant shift in approach. BeSmartee is leading this transition by moving away from custom development toward a highly configurable SaaS model.

This new approach streamlines loan manufacturing by making our mortgage solution faster to implement, easier to maintain, and more scalable, while still offering the flexibility our lender partners need.

Our Bright POS and Bright Connect mobile app exemplify this evolution, offering faster implementation (weeks instead of months), simplified workflows and configurations, reduced reliance on custom code, and intuitive user interfaces that reduce training time.

This configurable approach ensures lenders can quickly adapt to market changes and borrower expectations without lengthy development cycles, ultimately strengthening the trust relationship between lenders and borrowers through more responsive, transparent systems.

Roundup

Trust is no longer built through face-to-face meetings alone but it’s reinforced through every digital interaction. To stay competitive and meet borrower expectations, mortgage lenders need to integrate transparency, clarity, and responsiveness into every step of the loan journey.

By using borrower dashboards, automated updates, and simple, educational communication, lenders can strengthen relationships and reduce friction. And while AI and automation can generate initial content or system messages, the human touch still plays a key role. Editing tone, refining clarity, and optimizing for SEO all ensure that what borrowers see feels thoughtful and accurate – not robotic.

In a digital-first market, trust is built not just through what you say, but how clearly, consistently, and conveniently you say it.

Discover how BeSmartee’s mortgage product suite can enhance transparency and efficiency in your lending process. Start your transformation here to elevate borrower trust.