Modern banking is under pressure. Mid-sized banks are being squeezed by rising origination costs, ever-changing compliance demands, and growing borrower expectations for fast, digital-first experiences. While some banks respond by pouring more time and money into customizing old systems, others are realizing there’s a smarter path forward, a configurable mortgage point of sale (POS).

At a time when margins are thin and agility is everything, the difference between customized and configurable mortgage tech isn’t just semantics. It’s a strategic choice that determines how fast you can adapt, how efficiently you can operate, and how consistently you can serve borrowers across markets.

That’s why the most forward-thinking banks are embracing configurable mortgage POS systems to simplify workflows, reduce tech debt, and scale lending operations with confidence.

Quick Take: What This Blog Covers

- Why traditional, custom-built mortgage tech no longer fits today’s banking realities

- The power of configurable POS solutions to drive consistency, agility, and lower costs

- How banks can deliver better borrower experiences without rebuilding from scratch

- A look at the Bright mortgage product suite and the July 23 webinar that dives deeper into this shift

Table of Contents

Why Custom Mortgage Tech Is Holding Banks Back

Over the last decade, many mid-sized banks built their digital lending experience through a patchwork of integrations, homegrown tools, and vendor-led customizations. These setups once offered flexibility, but now they’ve become a burden.

Here’s what banks are up against:

- High maintenance costs: Every minor change requires developer time or external support.

- Fragmented borrower experiences: Without standard workflows, each loan officer handles things differently.

- Inflexibility: Adapting to new regulations, investor guidelines, or loan products often breaks existing systems.

- Slower time-to-market: Custom updates delay launches and reduce your ability to stay competitive.

In an industry defined by change, custom mortgage tech creates operational drag. The result? Slower approvals, more friction, and lost business.

What Makes a Mortgage POS “Configurable?”

A configurable mortgage POS is built from the ground up to support change, not resist it. Rather than relying on complex tech updates or rigid workflows, it allows banks to adjust functionality through settings, toggles, and prebuilt templates.

This approach enables:

- Dynamic workflows tailored by channel, product, or borrower type

- Rules-based automations that reduce manual follow-up and ensure consistency

- Easily configurable settings allow banks to adjust core workflows without relying on complex backend technology or developer support.

- Permission-based user roles and dashboards for LO teams, compliance, and borrowers

- Faster updates that don’t require developers or external vendors

A configurable SaaS model makes your mortgage POS more flexible without being fragile. You stay in control, without being in the weeds.

Standardized Lending Workflows: The Efficiency Banks Need

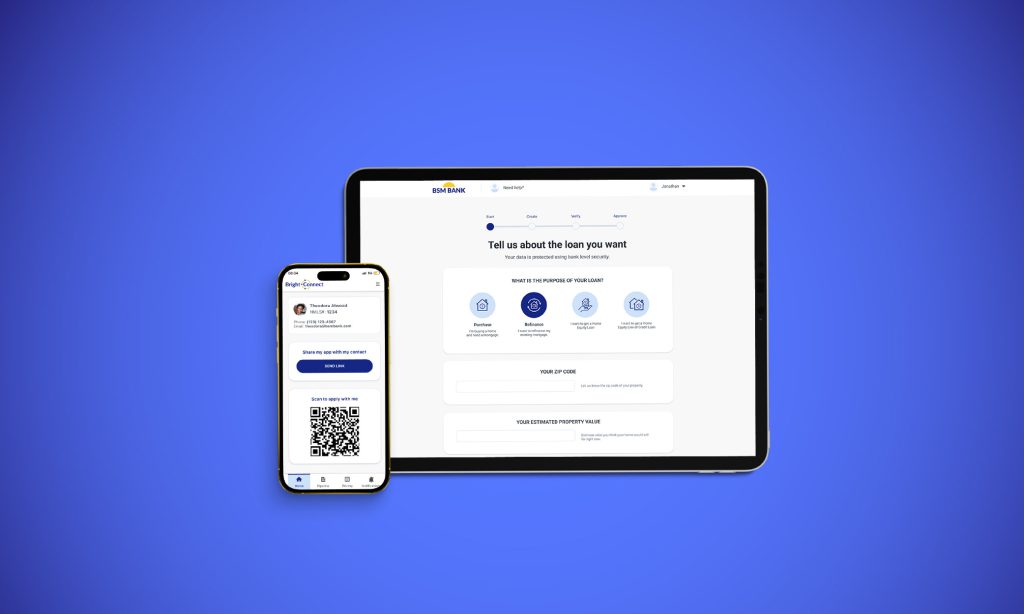

Configurable mortgage POS solutions like Bright POS and its native mobile app Bright Connect are designed to promote standardization where it matters most. By enabling flexible, rules-based workflow configuration, banks can enforce consistent processes across teams while leaving room for personalization where needed.

Benefits of standardizing key workflows include:

- Less rework: Standardized documents, checklists, and disclosures reduce back-and-forth.

- Faster onboarding: New LOs or processors get up to speed quickly with consistent tools and templates.

- Streamlined maintenance: Reducing technical debt makes it easier to scale without extra developer support.

- Better borrower experience: Consistency builds trust, and trust drives conversion.

Whether you’re managing a distributed lending team or expanding into new markets, standardized workflows help ensure every borrower gets the same quality of experience, without overburdening your staff.

Reconnecting Banks and Borrowers Through Simpler Tech

Many banks today are out of sync with their borrowers. While consumers expect a transparent, mobile-friendly lending experience, outdated mortgage POS systems leave them guessing what’s next or waiting for manual updates.

A modern, configurable mortgage POS helps banks close that gap with:

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- A fully integrated native mobile app that offers messaging, push notifications, and real-time loan progress tracking

- Unified dashboards for both borrowers and bank staff to view status and manage documentation

- Configurable alerts and checklists that align with internal processes and compliance requirements

- Support for co-borrower workflows and multiple borrower profiles, critical for more complex applications

The goal isn’t just speed but clarity. When borrowers know where they stand, they’re more likely to complete the process, less likely to shop elsewhere, and more inclined to trust your institution long term.

Why Now? The Industry Is Ready for Change

The push toward standardization isn’t just about convenience; it’s about competitiveness. With new entrants reshaping the mortgage experience and tech budgets under scrutiny, mid-sized banks must make smarter investments.

That’s why BeSmartee is hosting a live webinar on July 23, 2025, designed specifically for mortgage professionals looking to move faster without sacrificing flexibility.

In this session, BeSmartee CEO Tim Nguyen and COO David King will cover:

- Why highly customized systems are no longer sustainable

- How configurable SaaS reduces time-to-market and total cost of ownership

- Real examples of banks using Bright to scale smarter, not harder

- What’s next for BeSmartee’s Bright suite

If your tech team is overwhelmed or your lending operations feel outdated, reserve your spot here to see how the right tech strategy can simplify and scale your lending operations.

From Complexity to Clarity With the Bright Mortgage Suite

At BeSmartee, we’ve spent years helping lenders build digital mortgage POS experiences tailored to their needs. What we’ve learned is this: custom development works, until it doesn’t.

That’s why we created the Bright mortgage suite, built around a configurable SaaS model that gives banks control over how their workflows run, without the cost or complexity of traditional customization.

Bright POS and Bright Connect combine:

- Rules-based workflow configuration tools tailored to each lending environment

- A native mobile experience via Bright Connect

- Role-based dashboards and real-time visibility for everyone involved in the loan process

- Configurable alerts and document workflows designed to reduce manual tasks and support faster, more consistent loan processing

The result is a solution that flexes as your business grows, while reducing tech burden, minimizing training time, and improving loan cycle speed.

Roundup

Custom-built mortgage platforms were built for a different era. Today, mid-sized banks need technology that adapts to change, scales with demand, and makes every part of the lending process simpler.

A configurable mortgage POS is the smarter, faster, and more sustainable way forward.

By shifting away from customization and embracing a configurable SaaS model, your bank can:

- Standardize without losing flexibility

- Modernize without overhauling infrastructure

- Reconnect with borrowers in a way that builds trust and drives results

Want to see how a configurable mortgage POS can help your bank scale smarter? Talk to our team to explore the Bright mortgage product suite today.