Midsize lenders are under pressure from both sides. On one end, borrowers expect a fast, digital-first mortgage experience that feels intuitive and mobile-ready. On the other hand, rising origination costs, tighter margins, and operational constraints make it difficult to justify major technology overhauls. For many midsize lenders, the challenge isn’t whether to modernize. It’s how to do it without taking on unnecessary cost, complexity, or risk.

This disconnect has created space for a new approach to mortgage technology. Rather than pursuing full POS rebuilds or piling on disconnected tools, many midsize lenders are rethinking their strategy altogether. A Lite Mortgage POS offers a pragmatic path forward. It focuses on improving application conversion, reducing abandonment, and streamlining borrower intake, all while keeping implementation light and investment manageable.

Key Insights at a Glance

- Midsize lenders face unique constraints that make full POS rebuilds impractical.

- Application abandonment is one of the biggest unseen revenue leaks in the mortgage funnel.

- Lite Mortgage POS platforms focus on conversion and speed, not unnecessary complexity.

- Faster implementation and lower cost allow lenders to modernize without operational strain.

- BrightLite is an example of how Lite POS models help midsize lenders convert more applications without scaling headcount.

Table of Contents

The Midsize Lender Reality: Caught Between Growth and Constraint

Midsize lenders sit in a difficult middle ground. They are often too complex for manual or lightweight solutions, but not positioned to absorb the cost and disruption of enterprise-scale systems. Legacy POS platforms may be limiting borrower experience, yet replacing them outright can feel like a risky, multi-year commitment.

At the same time, midsize lenders face intense competitive pressure. Borrowers comparing options online expect clarity, speed, and transparency from the very first click. When applications feel slow, confusing, or fragmented, borrowers don’t wait around. They abandon the process and move on.

This creates a fundamental tension: lenders need better conversion, but they cannot afford to “boil the ocean” to get it.

Why Application Abandonment Hits Midsize Lenders Hardest

Application abandonment isn’t just a borrower experience issue. For midsize lenders, it’s a direct revenue problem.

Each abandoned application represents:

- Marketing dollars already spent

- Loan officer time partially invested

- Data partially entered but never realized

- Opportunity lost before underwriting even begins

Unlike larger institutions with massive volume to absorb losses, midsize lenders feel abandonment more acutely. Improving even a small percentage of completion rates can significantly impact funded loan volume without adding new lead sources.

This is where Lite POS platforms start to change the conversation. Instead of focusing on everything a full POS could do, the focus shifts to what actually moves the needle: getting borrowers to finish applications.

What a Lite Mortgage POS Is Designed to Do

A Lite Mortgage POS is intentionally narrow in scope but high in impact. It targets the stages where borrowers are most likely to stall or abandon, and it streamlines those moments without requiring deep customization or prolonged implementation.

At its core, a Lite POS emphasizes:

- Guided application flows that reduce confusion

- Pre-configured workflows built on best practices

- Faster borrower onboarding with fewer required steps

- Mobile-friendly tools that keep borrowers engaged

- Automation that removes unnecessary manual follow-up

Rather than replacing every operational system, a Lite POS strengthens the front end of the mortgage funnel where conversion matters most.

For midsize lenders, this makes modernization achievable without disrupting existing backend processes.

Why This Model Fits the Midsize Lender Reality

Technology decisions for midsize lenders are rarely just about features. What matters more is how quickly a solution delivers value, how much it costs to own over time, how it impacts staff workload, and whether it allows the organization to scale gradually without forcing a major transformation. Lite POS platforms align well with those realities.

Lower Financial Commitment

Lite POS solutions typically require significantly lower upfront investment than full platforms. This reduces risk and makes ROI easier to measure against real conversion lift.

Faster Implementation

With pre-optimized workflows and minimal configuration, lenders can launch in weeks rather than months. That means improvements show up in the current pipeline, not a future roadmap.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Operational Efficiency

Instead of adding more people to chase incomplete applications, automation and guidance help borrowers self-progress. This lets teams focus on high-quality applications instead of administrative cleanup.

For midsize lenders balancing growth and cost control, these tradeoffs matter.

When Lite POS Becomes the Strategic Starting Point

Many lenders previously treated technology as an all-or-nothing decision. Either implement a full POS or stick with what you have. Lite POS models introduce a smarter alternative: start where the impact is highest.

For midsize lenders, this often means:

- Fixing application abandonment first

- Improving borrower experience without a full rebuild

- Testing modernization before committing to larger change

- Creating a scalable foundation for future upgrades

In this way, Lite POS platforms become less about limitation and more about sequencing.

Where BrightLite Fits In

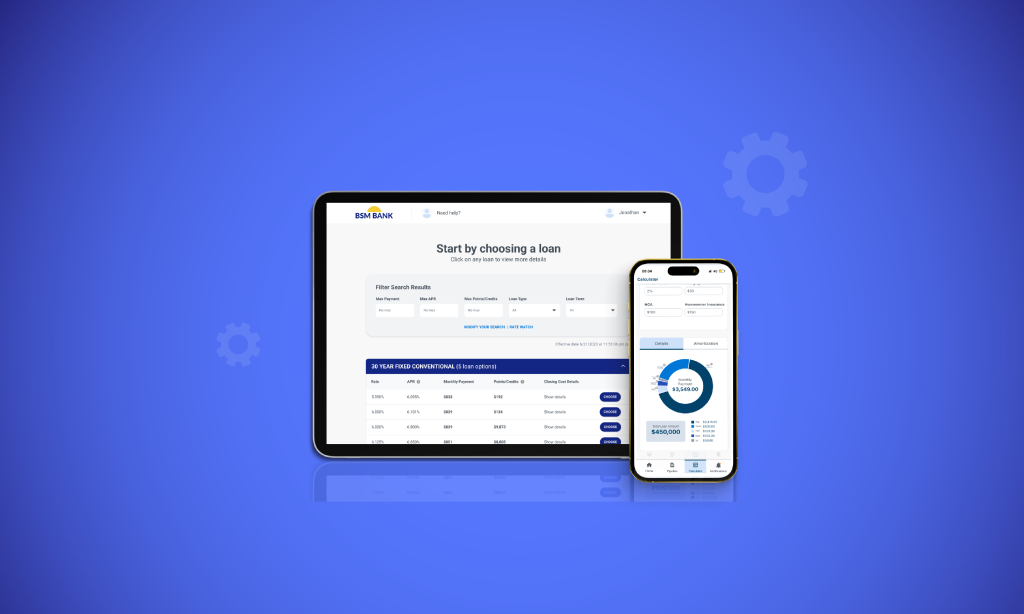

This is where BrightLite enters the picture, not as a replacement for every system, but as a focused revenue engine designed specifically around borrower conversion.

BrightLite is built to help lenders address the most common breakdowns in the mortgage funnel:

- Stop application abandonment

- Increase completed submissions

- Reduce origination waste

- Capture more revenue from existing lead flow

Rather than forcing lenders into a heavy transformation, BrightLite delivers these outcomes through practical design choices. Its pre-configured, best-practice workflows remove guesswork at the front of the funnel, while intelligent automation guides borrowers step by step toward completion. BrightLite integrates application and credit within Encompass, helping streamline early-stage intake, and includes a mobile companion app that enables document uploads and status visibility for borrowers. Configurable branding and lender templates support a consistent borrower experience without added complexity.

With reported 80-85% application submission rates, BrightLite shows how a Lite POS approach can materially improve conversion without increasing operational complexity. For midsize lenders, that balance of performance and simplicity is exactly the appeal.

Q&A: Lite POS for Midsize Lenders

Q: Is a Lite POS only for smaller lenders?

A. Not at all. Many midsize lenders use Lite POS platforms as a focused conversion layer alongside their existing infrastructure.

Q: Can a Lite POS scale over time?

A. Yes. A well-designed Lite POS provides a modern borrower experience today while creating a bridge to broader digital transformation when the business is ready.

Q: Does Lite POS reduce the role of loan officers?

A. No. It removes administrative friction so LOs can spend more time advising borrowers and less time chasing incomplete applications.

Roundup

Lite Mortgage POS platforms are gaining traction with midsize lenders because they align with real-world constraints. They deliver measurable improvements in borrower conversion without forcing lenders into costly, disruptive technology projects. By focusing on application completion, speed, and borrower guidance, Lite POS solutions help lenders do more with what they already have.

For midsize lenders navigating margin pressure and competitive borrower expectations, Lite POS isn’t a shortcut. It’s a practical strategy. One that improves efficiency today, protects revenue through market cycles, and leaves room to scale when the time is right.

Looking for a faster, lower-risk way to improve conversion and modernize your borrower experience? Explore how BrightLite helps midsize lenders turn more applications into revenue.