The mortgage lending industry is undergoing a significant transformation. Driven by increasing regulatory pressures, economic uncertainties, and rising borrower expectations, lenders are compelled to reevaluate and modernize their operations. A key indicator of this shift is the adoption of digital technologies; notably, the use of artificial intelligence (AI) in mortgage lending surged from 15% in 2023 to 38% in 2024, reflecting a growing commitment to digital transformation across the sector.

For years, the industry has relied on legacy systems, manual processes, and fragmented workflows. But today, regulators are not just encouraging modernization; they’re making it essential. Compliance demands are growing, timeframes are tightening, and documentation standards are becoming more rigorous.

For lenders looking to stay competitive and compliant, adapting to this new environment is no longer optional.

Table of Contents

Why Regulatory Changes Are Forcing a Shift

New and updated regulations are fundamentally reshaping the mortgage industry. These changes are designed to protect consumers, increase transparency, and prevent systemic risk, and to elevate expectations for how lenders operate throughout the mortgage process. As a result, regulatory compliance is no longer confined to the back office. It affects systems, staffing, and overall business strategy.

To remain compliant, lenders must manage and analyze more data than ever before, meet tighter deadlines, and produce more thorough documentation across the loan lifecycle. Manual processes simply can’t keep up with this volume and complexity.

A few key regulatory drivers include:

- Increased scrutiny on fair lending practices: Lenders must demonstrate that their underwriting and decision-making processes are transparent, consistent, and free of bias. This demands better data visibility and audit trails.

- Data governance and privacy regulations: With evolving requirements under laws like the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA), lenders must ensure secure handling of sensitive borrower information.

- Timely disclosures and real-time updates: Borrowers expect accurate and up-to-date information, which regulators now require as well, from rate quotes to loan status.

- Home Mortgage Disclosure Act (HMDA) updates: Expanded data collection fields and stricter reporting requirements make manual processing nearly impossible to scale efficiently.

These changes are pushing lenders to upgrade their systems, standardize workflows, and deliver more responsive, automated processes. The only way to keep pace is by embracing digital transformation.

Digital Transformation: A Strategic Imperative

Digital transformation in mortgage lending doesn’t just help lenders stay compliant, it helps them operate more efficiently, reduce risk, and improve the borrower experience. Here are the main ways it supports compliance and competitiveness:

1. Centralized, Auditable Data

Digital systems offer structured, real-time data capture and storage. With the right technology, lenders can trace the full history of a loan, starting from application to close—with every data point securely logged. This level of transparency is exactly what regulators are looking for during audits or investigations.

2. Automation of Repetitive Tasks

Tasks like document classification, data entry, and status updates are ripe for automation. By removing manual steps, lenders minimize the chance of human error and reduce the time it takes to move loans through the pipeline. Automation also ensures a consistent process, which is crucial for demonstrating fair lending compliance.

3. Improved Borrower Communication

Regulators emphasize borrower rights and timely disclosures. Digital mortgage platforms make it easier to keep borrowers informed through real-time updates, e-signatures, automated notifications, and borrower dashboards.

4. Enhanced Reporting Capabilities

With regulatory reporting becoming more data-intensive, digital tools provide the analytics and dashboards lenders need to compile, review, and submit accurate reports on time.

BeSmartee’s Approach to Digital Transformation

At BeSmartee, we understand that regulatory shifts can present significant challenges. That’s why our mortgage product suite is built to help lenders meet evolving requirements without slowing down or adding operational overhead.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Our technology enables:

- Fast, compliant borrower onboarding.

- Streamlined document management.

- Real-time communication between loan officers, processors, and borrowers.

With our solution, lenders can adapt to change, not just react to it.

Simplifying Digital Transformation with a Configurable Approach

Historically, many lenders relied on custom-built mortgage technology that required extensive development time and constant vendor involvement. While custom solutions can offer deep personalization, they often come with high costs, long implementation cycles, and difficulty keeping up with regulatory or market changes.

BeSmartee is leading a shift away from this model.

Instead of custom development, we now offer a highly configurable SaaS (Software-as-a-Service) model. This approach empowers lenders with tools that are:

- Faster to implement: Go live in weeks instead of months.

- Easier to maintain: Reduce IT burden and simplify updates.

- More scalable: Adapt easily as your business grows or regulations change.

- Customizable without coding: Adjust workflows, branding, and borrower experiences through intuitive configuration settings.

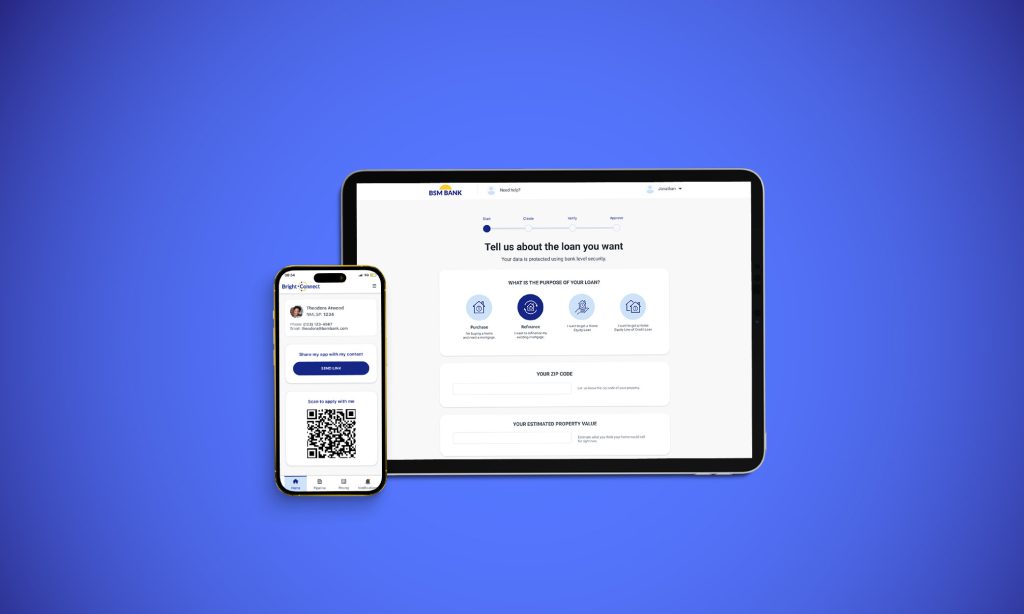

Our Bright POS and Bright Connect mobile app reflect this new direction. These solutions streamline the mortgage process with configurable modules, dynamic workflows, and interfaces that are intuitive for both borrowers and loan officers.

This shift enables our lender partners to keep up with regulatory updates and borrower demands in a way that’s sustainable, efficient, and cost-effective.

The Competitive Advantage of Compliance-Driven Technology

Complying with new regulations is necessary, but it can also be a powerful differentiator. Lenders who adopt digital solutions not only meet regulatory requirements but also position themselves to serve borrowers better and operate more efficiently.

Key competitive benefits include:

- Faster loan cycles: Automation reduces time from application to close.

- Improved borrower satisfaction: Transparency and responsiveness build trust.

- Lower operational costs: Fewer errors, faster workflows, and reduced manual labor.

- Stronger data insights: Make informed decisions with real-time analytics.

- Easier scalability: Grow without compromising quality or compliance.

Roundup

Regulatory changes are more than just legal obligations. They are catalysts for modernization. Lenders who treat compliance as a strategic opportunity rather than a burden can unlock new efficiencies, build borrower trust, and future-proof their operations.

Connect with our team to see how Bright POS and Bright Connect can help simplify digital transformation for your mortgage business.