In commercial lending, accurate and timely data analysis is essential for staying competitive. Lenders depend on clear, consistent financial information to make fast and confident credit decisions. Yet, despite enormous advances in financial technology, many institutions still rely on manual spreading—a method that might feel familiar but is costing more than most realize.

Behind every spreadsheet and scanned PDF lies a hidden drain on time, resources, and revenue. Manual spreading introduces unnecessary risk, reduces operational efficiency, and limits your institution’s capacity to grow. It slows down deals, frustrates analysts, and, perhaps most damaging, allows your competitors to outpace you.

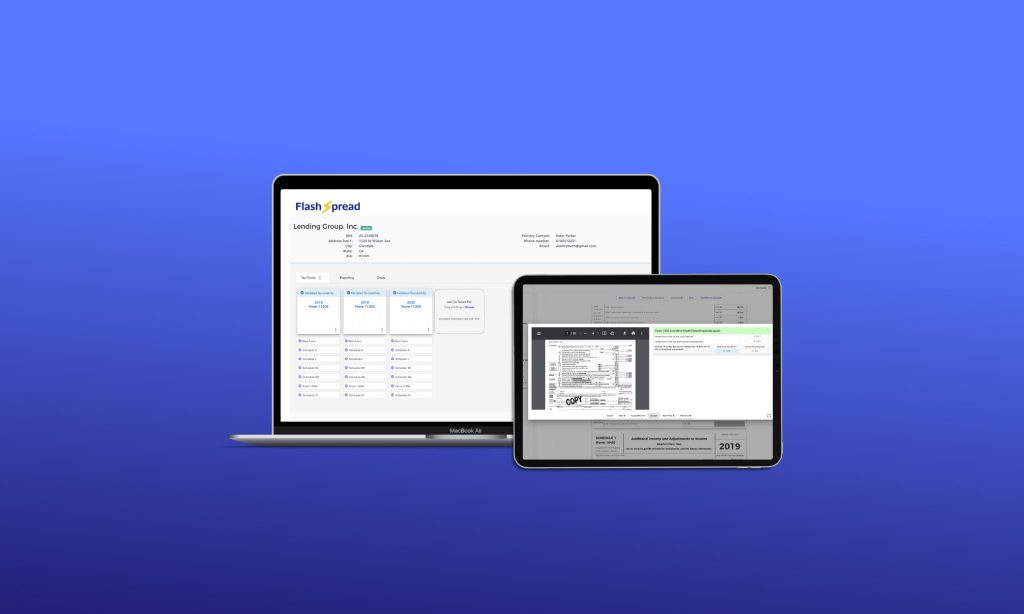

In this post, we uncover the full extent of these hidden costs and explore how automating the spreading process through solutions like FlashSpread can transform the way you work.

Table of Contents

What is Manual Spreading?

In commercial lending, “spreading” reviews a borrower’s financial documents (typically tax returns, income statements, and balance sheets) and enters that data line by line into spreadsheets or underwriting platforms. This process allows credit analysts to calculate financial ratios, assess risk, and make lending decisions.

Manual spreading is repetitive, time-consuming, and vulnerable to error. Financial analysts often spend hours copying data, classifying line items, and double-checking entries to ensure calculations are accurate. While precision is essential, the tools used are outdated for the speed and scale today’s lending environment demands.

The Hidden Costs Behind the Process

Manual spreading may seem manageable on the surface, but the deeper costs quickly add up across the organization.

1. Human Error

Even highly experienced analysts can make mistakes. A misclassified revenue line, a missing figure, or an incorrect formula can lead to significant miscalculations. These errors can impact loan pricing, risk grading, and even result in granting loans to unqualified borrowers or rejecting viable ones.

2. Loss of Time and Productivity

Analysts can spend hours per application just entering and verifying data. When scaled across hundreds of applications per month, this results in an enormous amount of time spent on repetitive tasks instead of high-value analysis or decision-making.

3. Delayed Turnaround Times

Commercial borrowers are savvy. They expect fast responses and seamless experiences, especially when evaluating lenders. If your underwriting process takes days longer than a competitor’s due to manual steps, your prospects will likely move on.

Speed is no longer a luxury but a requirement.

4. Compliance and Audit Risks

Manual workflows tend to lack consistent documentation and audit trails. This creates vulnerabilities when regulators or internal teams need to verify the data flow. Automation ensures every action is logged and standardized for easier compliance.

What You’re Leaving on the Table

Beyond inefficiencies and risk, manual spreading keeps lenders from seizing valuable growth opportunities.

1. Limited Real-Time Insights

Data entered into spreadsheets becomes difficult to access or aggregate for meaningful analysis. Automation allows institutions to centralize and analyze borrower financials across portfolios, improving strategic decision-making.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

2. Missed Cross-Sell and Upsell Potential

When financial insights are buried in static documents, it’s harder to recognize patterns or anticipate borrower needs. Clean, structured data supports more targeted offers and deeper borrower engagement.

3. Stalled Portfolio Growth

Relying on manual workflows means your ability to grow is tied directly to hiring. Automation breaks that dependency, enabling your team to handle more volume without more headcount.

4. Difficulty Scaling Operations

As the business grows, so do document volumes. Manual methods don’t scale efficiently. Without automation, lenders hit growth ceilings much earlier—and often can’t expand without compromising speed or quality.

A Smarter, Safer Way Forward: Automating Financial Spreading

If manual spreading is the bottleneck, automation is the key to unlocking efficiency, accuracy, and scale.

Why Automation Works

Solutions like BeSmartee’s FlashSpread automate the extraction and analysis of financial statements. Built specifically for commercial lenders, FlashSpread uses Optical Character Recognition (OCR) and intelligent parsing to extract key figures from tax documents and generate complete financial spreads within seconds. The solution seamlessly integrates into existing loan origination systems, allowing lenders to continue using their familiar workflows but with added efficiency and accuracy.

Key Benefits of FlashSpread

- Speed and Efficiency: Automation enables lenders to process financial documents in minutes, drastically reducing the time spent on manual data entry and freeing up analysts to focus on higher-value tasks like risk assessment and strategy development.

- Accuracy and Consistency: With intelligent parsing, FlashSpread reduces human error. It ensures that financial data is consistently and accurately extracted, minimizing the risk of miscalculations and faulty credit decisions.

- Scalability: As your loan volume increases, FlashSpread can handle the load without additional headcount. It helps lenders grow without the constraints of manual processes, enabling more efficient use of resources.

- Improved Borrower Experience: With faster processing times, your institution can deliver quicker loan decisions, improving the borrower experience and enhancing your competitive position.

- Audit and Compliance Ready: FlashSpread creates standardized, easily auditable data trails, making it simpler for your team to stay compliant and respond to regulatory inquiries.

Is Your Institution Ready to Evolve?

Clinging to manual spreading in 2025 is like using a rotary phone in the age of smartphones. It’s time to rethink what’s possible in commercial lending.

You don’t need to overhaul your entire operation overnight. Start by identifying high-volume, repeatable workflows where automation can deliver quick wins. With minimal integration and a high ROI, tools like FlashSpread offer a low-risk path to modernization.

Roundup

Manual spreading may have been the industry norm for decades, but in today’s environment, it’s a liability. The risks of data entry errors, delays, limited scalability, and opportunity costs are too significant to ignore.

The future of commercial lending belongs to institutions that prioritize agility, accuracy, and efficiency. Automation tools like FlashSpread help you eliminate bottlenecks, unlock new capacity, and deliver the fast, transparent experience borrowers expect.

It’s not just about keeping up; it’s about getting ahead.

Ready to ditch manual spreading? Contact us today and discover how FlashSpread can transform your lending operations.