Compliance has always been part of the job for commercial lenders. But in today’s environment, where regulations evolve quickly, borrower expectations are higher, and the cost of mistakes has never been greater, it can feel like a constant uphill climb.

For SBA and commercial lenders, the challenge is how to meet requirements without slowing down deal flow, overburdening staff, or creating friction for borrowers. Done wrong, compliance becomes a bottleneck. Done right, it strengthens both portfolio resilience and borrower trust.

So how do lenders simplify compliance without sacrificing accuracy? This guide explores practical strategies to reduce headaches while still keeping regulators, borrowers, and internal teams aligned.

Key Insights at a Glance

- Standardizing compliance processes reduces errors and audit risk

- Technology-driven automation keeps documentation accurate and timely

- Efficiency in compliance workflows frees staff to focus on relationships and growth

- Consistent documentation strengthens SBA guarantee eligibility

- Proactive monitoring helps lenders spot compliance gaps before they trigger penalties

Table of Contents

Why Compliance Feels Harder Than Ever

The stakes for compliance have grown sharper. Regulations aren’t static, they’re constantly evolving to reflect changes in lending practices, economic conditions, and borrower protections.

For SBA and commercial lenders, three challenges rise to the top:

- Changing SBA guidance: Loan program requirements shift with policy changes, making it difficult for lenders to stay current without dedicated resources.

- Documentation overload: Each borrower file requires detailed records, from tax returns to risk assessments, leaving plenty of room for mistakes or omissions.

- Pressure for speed: Borrowers expect fast approvals. Compliance, if handled manually, often slows down the process, creating tension between regulatory obligations and customer service.

When compliance consumes too much time or resources, lenders risk delayed closings, frustrated clients, and increased exposure to penalties.

The Cost of Compliance Gaps

Compliance failures aren’t just a legal problem, but they directly affect a lender’s ability to compete. The risks include:

- Financial penalties: Missed documentation or inaccurate reporting can trigger costly fines.

- Audit red flags: Inconsistent processes raise concerns during audits, leading to more scrutiny and disruption.

- Reputation loss: Borrowers lose confidence when errors or delays suggest a lender isn’t organized or reliable.

For SBA lenders specifically, the stakes are even higher. If loan files don’t meet program standards, the SBA can deny the guarantee, leaving lenders fully exposed to borrower defaults. For commercial lenders, noncompliance can also complicate secondary market sales, as investors often demand complete and verified documentation before purchasing loans. These ripple effects can shrink profitability and slow portfolio growth.

Making Compliance Work for You

The good news: compliance doesn’t have to be an obstacle. With the right practices and tools, lenders can integrate compliance into workflows in ways that feel natural and efficient.

Key strategies include:

- Create standard checklists: Ensure every loan type, especially SBA loans, has a clear compliance roadmap that staff can follow.

- Centralize documentation: Digital systems reduce the risk of misplaced files and make it easier to track borrower requirements.

- Train continuously: Compliance isn’t static; ongoing training helps staff adapt quickly to new rules or program adjustments.

By making compliance part of everyday operations instead of a separate, burdensome task, lenders reduce stress and build consistency.

Efficiency as a Compliance Advantage

One of the most overlooked aspects of compliance is efficiency. When workflows are streamlined, compliance naturally improves. Manual processes, however, create problems:

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- Delays: Staff spend hours collecting and rekeying borrower data, leaving less time for actual risk review.

- Errors: Hand-entered financial data creates discrepancies that can derail both compliance and underwriting.

- Inconsistent results: Different staff handling compliance tasks differently raises audit risks.

Inefficiency doesn’t just create internal headaches but it also impacts borrower perception. When compliance delays push closings back, borrowers often assume the lender is disorganized. This damages credibility and makes it harder to compete with lenders who have already embraced automation. On the flip side, lenders that streamline compliance workflows can position themselves as both reliable and fast, a powerful combination in competitive markets.

Automation helps resolve these issues by embedding compliance checkpoints directly into everyday workflows. When documentation is collected, verified, and organized faster, compliance becomes less about scrambling at the end and more about confidence at every step.

Q&A: Common Compliance Questions From Lenders

Q: How can we keep up with SBA guideline changes?

A: Subscribe to SBA bulletins, join industry associations, and leverage platforms that update forms and requirements automatically.

Q: What’s the best way to reduce audit stress?

A: Consistency. Use standardized workflows and checklists to ensure every loan file meets the same requirements before it’s reviewed.

Q: Does compliance always slow down approvals?

A: Not necessarily. With automation and centralized systems, compliance steps can run parallel to underwriting, keeping deals on track without added friction.

From Pain Point to Productivity: Reducing Manual Spreading

One of the most time-consuming compliance steps is ensuring financial documentation is accurate and complete. Manual spreading of borrower tax returns or financial statements creates multiple risks:

- Missing or miskeyed data that triggers compliance concerns

- Slowed turnaround times that frustrate borrowers

- Increased audit exposure from inconsistent file handling

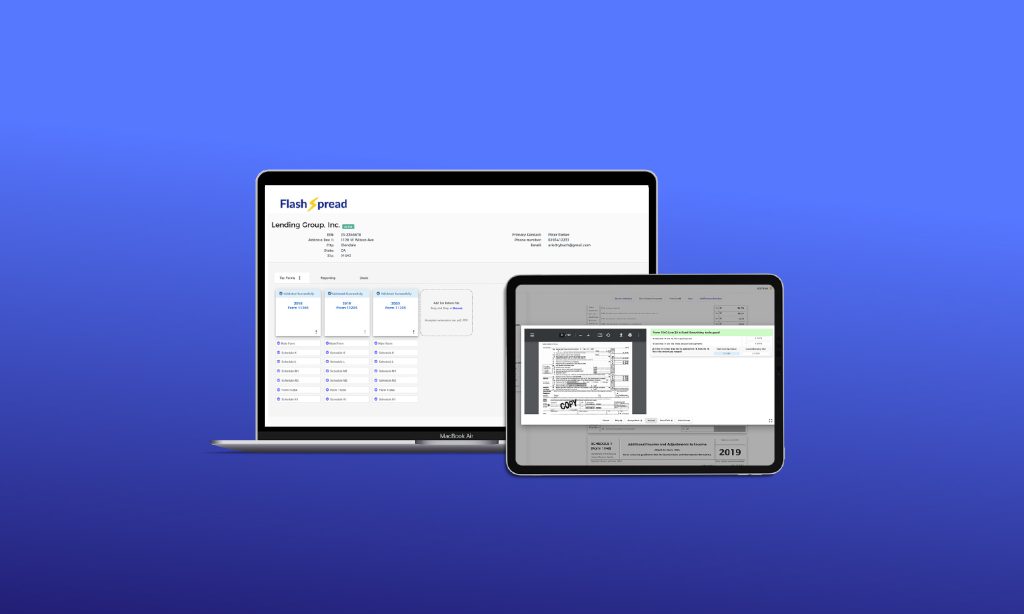

FlashSpread in Action

FlashSpread automates the spreading process by extracting and organizing financial data directly from borrower tax returns and scanned financials in minutes. Instead of compliance staff rekeying information, they get a structured, consistent file that supports both underwriting and regulatory requirements.

With FlashSpread, lenders can:

- Eliminate repetitive data entry that slows down compliance checks

- Access key ratios like DSCR faster, supporting both risk analysis and SBA reporting

- Maintain consistent documentation standards across loan files

- Reduce audit exposure by ensuring cleaner, more accurate records

By turning manual bottlenecks into streamlined workflows, FlashSpread doesn’t just improve efficiency; it strengthens compliance outcomes.

Roundup

Compliance isn’t optional, but it doesn’t have to be a burden. For SBA and commercial lenders, maintaining portfolio health and building borrower trust depend on meeting requirements efficiently without slowing down the lending process. By standardizing processes, centralizing documentation, and leveraging automation tools, lenders can transform compliance from a source of stress into a strategic advantage, ensuring greater consistency, reducing manual work, and strengthening relationships with borrowers.

Ready to reduce compliance headaches while protecting portfolio health? Let’s connect and explore how FlashSpread can help.