Every lender knows how much effort it takes to attract new borrowers. From marketing spend to lead nurturing to application processing, acquisition costs are high and getting higher. But what if the most profitable growth strategy isn’t just about bringing in new business, but about keeping the business you already have?

Borrower loyalty has always mattered, but in today’s competitive market, it’s becoming a true differentiator. The reality: repeat borrowers and referral-based clients tend to be cheaper to acquire, more profitable, and more likely to stay engaged over time. In fact, research shows that a 5% increase in customer retention can increase profits anywhere from 25% to 95%.

For lenders, the challenge isn’t only to close the first loan. It’s about creating experiences that inspire trust, build satisfaction, and encourage borrowers to come back when it’s time to refinance, purchase again, or refer a friend.

Key Insights at a Glance

- Borrower loyalty reduces acquisition costs and boosts long-term profitability.

- First-time borrowers can become repeat clients and referral sources if nurtured correctly.

- Trust, personalization, and communication are the foundation of loyalty.

- A modern mortgage POS helps lenders turn more of the right applicants into loyal borrowers by reducing drop-offs, streamlining applications, and increasing conversion rates.

Table of Contents

Why Borrower Loyalty Matters More Than Ever

Borrowers have more options than ever before. Online marketplaces, digital-first lenders, and traditional banks all compete for the same audience. In this crowded space, loyalty becomes a strategic advantage.

Here’s why:

- Lower costs: It costs far less to keep a satisfied borrower than to acquire a new one.

- Higher profitability: Loyal borrowers are more likely to refinance, take out additional products, or recommend their lender.

- Competitive resilience: Lenders with strong borrower relationships are less vulnerable to rate-driven competition.

Think about the ripple effects of loyalty: A borrower who refinances with you doesn’t just generate another loan; they often bring their network with them. A single loyal borrower might refer a sibling shopping for their first home or a colleague considering an investment property. Those second-order referrals often carry higher trust, meaning they move through the funnel faster and with fewer objections. Over time, loyalty compounds into a self-sustaining growth loop.

Borrower loyalty doesn’t just improve retention metrics but directly impacts the bottom line.

Building Trust From Day One

Loyalty starts with the first impression. If borrowers feel misled, confused, or ignored early on, they’re unlikely to return. Transparency and proactive communication set the stage for long-term relationships.

Practical approaches include:

- Clear expectations: Be upfront about rates, timelines, and documentation requirements.

- Real-time updates: Provide consistent status notifications to reduce uncertainty.

- Responsive support: Ensure borrowers can get quick answers to their questions.

- User-friendly tech: Leverage intuitive front-end mortgage tools that guide borrowers step-by-step through applications.

Trust is especially critical for first-time homebuyers, who often enter the process overwhelmed by jargon and paperwork. By offering educational touchpoints, like explainer videos, pre-approval checklists, or live Q&A webinars, lenders can position themselves as partners rather than gatekeepers. That small shift in tone builds confidence and sets the stage for long-term loyalty.

Personalization as the Loyalty Driver

Borrowers aren’t looking for cookie-cutter lending. They expect personalized experiences that reflect their unique financial situation and goals.

Ways lenders can deliver personalization:

- Segment products for first-time buyers, investors, and refinancers.

- Use borrower data to recommend relevant next steps or products.

- Acknowledge milestones, from closing day to annual check-ins.

Personalization also extends to timing. For example, sending a helpful nudge to a past client six months before their adjustable-rate mortgage resets shows attentiveness and increases the likelihood of repeat business. Similarly, recognizing cultural or regional borrower preferences, like tailoring outreach around community events, demonstrates deeper care that borrowers remember when recommending a lender.

When borrowers feel understood, they’re more likely to return and to advocate for you with others.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Turning Satisfied Borrowers Into Referral Champions

Happy borrowers don’t just come back. They spread the word. Referrals are one of the most effective and affordable growth channels because they come with built-in trust.

Lenders can maximize referral potential by:

- Following up after closing to thank borrowers and ask for recommendations.

- Offering compliant referral incentives where appropriate.

- Staying in touch with educational content or community events that keep the lender top-of-mind.

Even small gestures matter. A personalized thank-you note after closing or an anniversary check-in call can spark goodwill that turns into referrals months or years later. These touches may not directly mention lending, but they reinforce the borrower-lender relationship and keep your brand positioned as their first call when a friend or family member asks, “Do you know a good lender?”

Referrals transform loyalty from a retention strategy into a pipeline multiplier.

Technology as the Loyalty Engine

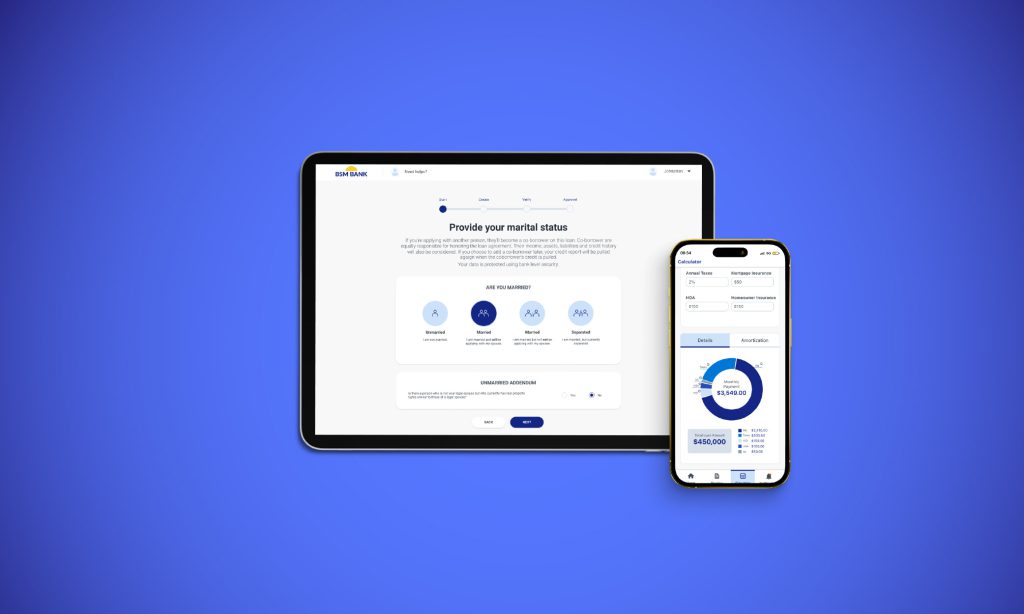

Relationships power borrower loyalty, but technology makes it scalable. A modern, configurable mortgage point-of-sale (POS) doesn’t just process applications; it creates consistency, transparency, and ease across the borrower journey.

BeSmartee’s Bright POS is designed with this in mind. By streamlining intake and reducing drop-offs, Bright helps lenders achieve an industry-best 85% application-to-borrower conversion rate.

In practice, that means:

- For applicants: A simple, intuitive digital mortgage experience that makes applying easier, faster, and less stressful.

- For loan officers: Automated workflows that fill pipelines and free up time to focus on building stronger borrower relationships.

- For lenders: Measurable ROI through higher conversion rates, lower acquisition costs, and stronger lifetime borrower value.

The outcome? More completed applications, more satisfied borrowers, and more opportunities for repeat business and referrals.

Q&A: Borrower Loyalty in Practice

Q: Isn’t borrower loyalty harder to measure than new lead generation?

A. Not necessarily. Retention metrics like repeat applications, referral volume, and borrower satisfaction surveys provide a clear picture of loyalty’s impact. Lenders who track these often find loyalty drives higher lifetime value than constant acquisition.

Q: How can smaller lenders compete with larger competitors when it comes to loyalty?

A. According to the Federal Reserve’s report, community and regional banks hold a strong advantage in relationship-based lending and local borrower knowledge. By leaning into personalization and fast decision-making, smaller lenders can strengthen loyalty even against national players.

Roundup

Borrower loyalty isn’t a soft metric; it’s a profitability driver. Loyal borrowers cost less to retain, generate repeat business, and power referrals that bring in new clients with minimal acquisition spend.

For lenders, the path is clear: build trust early, personalize experiences, and encourage referrals. With technology like Bright POS, these strategies become scalable, helping lenders transform first-time borrowers into lifelong clients.

Ready to build loyalty that pays off? See how Bright POS supports retention and referrals.