Since 2017, the progression of digitalization has been an extraordinary advancement for mortgage lenders, financial services organizations and even the GSE’s. However, these advancements have been implemented in silos of functionality resulting in innovation anomalies that require comprehensive digital transformations out of the reach of many enterprises due to complexities and investment demanded.

Digital transformations staged against an era of 5G, shifting economic forces, banking as a service (BaaS), mobile apps, electronic lending, exponential consumer apps and an angelic expectation of artificial intelligence (AI), the discussion of digitization and data seems — at this point — a bit Luddite. Do we accept the ascertains from over 90% of banking and mortgage executives that their digitalization efforts are moderately to highly advanced providing unprecedented customer value and acceptance? How does this confidence map to the AI banking solutions that only achieve 12% minimum ROI projections?

Data is the New Currency

Indeed, data is the new currency for most organizations. Data is how we define our partnership relationship value. Data is how we evaluate our employees and their skills. Data is how we define profitability. Data is how we now define FSBO’s and mortgage firms.

- Have we, as financial services and banking organizations (FSBO’s), reached a level of supremacy over our data assets?

- Are we anticipating the value (i.e. gains and pains) derived?

- Have our consumers properly placed their loyalty on our ability to safeguard their privacy and cybersecurity across systems, across the clouds and across our cascading decisioning (e.g. AI) systems?

- Do we have the auditability and accountability of our assets where over 65% of usable system data arrives from outside of our firewalls?

In the end, the real question is, do we quantitatively understand the business value (or risks) brought to us by vast-reaching data sourcing and governance processes, which now warrants an over 90% confidence in its value and integrity?

Moving into 2021-2025 with volumes likely to stagnate, the demand for operational efficiencies against costs and measurements which are continually driven by technology, leadership and organizational survivability will be defined by digital roadmaps, iterative innovations, and a continuous need for robust data governance and curation. The following panel highlights the impacts and sizes of the FSBO and mortgage markets and the hidden digital challenges residing just beneath the surface.

The Rise of Data as an Asset (and as a Competitive Weapon)

If we conservatively assume that the market statistics remain stable, we now can understand why non-traditional competitors are seeking to become FinTech companies under a FDIC November 2020 rule. These non-traditional firms already have vast amounts of quality consumer data and wish to extend their first point-of-contact farther down the financial services supply chains. As mortgage and banking firms, we have profited on being intermediaries within these long-tail supply chains. We take fees as part of the process, while matching investors to individual consumers providing for liquidity and risk mitigation. Yet, this process, like a regulated public utility, represents a commodity offering moving forward.

The rise of data as an asset (and a competitive weapon) places all commodity offerings (e.g., loans) into the disruptive chaos of disintermediation (a fancy term for shortening customer timeframes and steps). Why is this likely, you ask? The very push for data and digitization has created streamlined processes, advanced analytics and (profitable) consumer targeting that was previously unfathomable. Moreover, the advancements of innovation technologies in the form of mobility, data aggregation services and trust-verified apps has put the power of decisioning and behavioral changes directly with the consumer and their preferences — not the bankers or their organizational capabilities.

As banker goals of “fee-based income,” “householding” and “cross selling” move into the core capabilities of non-traditional suppliers (especially when we factor in cybercurrencies), the intermediary value within these now commoditized transactions becomes all about price — not value. This will drive down profitability, while increasing technology sophistication especially as FSBO’s reach out for the Holy Grail of automation — artificial intelligence. In the end, those who do not innovate to disrupt will fight over smaller transactions and slimmer margins.

When I wrote the 2020 series “Are Bankers Necessary?” I noted the reality that skilled FSBO personnel (e.g. underwriters) were commanding significant salary increases and signing bonuses. I noted that data had made skilled banking employees who leveraged data highly prized. Yet, this reality of why was not singularly about volume, but also about complex data and layered technology solutions. The most valued FSBO employees of 2020 were those who could leverage technology such as AI as part of their daily functions — not as some leaders think of replacing employees to gain efficiency.

New Data and Digital Offerings Demand for Layers of Innovation

The question and subsequent answers of how bankers and their organizations will remain relevant to consumers begins with the data — it is not an end-state. Data is the energy source, complex, multi-purposed and dangerous, if handled incorrectly. As FSBO’s push into the utopia of AI banking solutions sets to replace high-cost delivery personnel, who has the contingency plan (that works), should one AI system create inappropriate bias decisioning that is then cascaded to another, and to another, and then across a web of technologies — some of which are outside the corporate walls? What is the brand, financial and consumer risks of our data and the decisioning we derive from them, if they behave outside their designed control limits?

In the end, the adoption of mortgage data and technology solutions will not be successful using traditional approaches of buying a vendor offering and then planning to go-live. These new data and digital offerings demand layers of innovation including a reskilling of existing and future employees to leverage the offerings — not be replaced by them. Innovation of today and tomorrow demand building blocks (i.e. containers) that can be assembled, reassembled and retired in unique and adaptable ways.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Moreover, these building blocks, especially as intelligence is derived from data, must be auditable and accountable not just for results, but for ethical conduct and regulatory review. I do not think I will be able to use the defense of “we didn’t know what our artificial intelligence system was doing with the data, let go ask it what it’s logic was—we are not liable.”

This may all seem like conjecture based on the ravings of a Chief Innovation Officer and an educator of innovators. However, we only have to look back at the last financial cycle that crashed in 2008. Before this time, volumes were reaching over $3.5 trillion in originations. The government was facing uncertainty and the financial markets “thought they had it covered.” Consumers were driving up prices and the faith in financial engineering and technological sophistication were even per the regulators of the time “superior.” Everyone chased their competitors implementing turnkey solutions they were confident added top-quality returns to their value proposition — but the crash happened.

In the end, FSBO leaders recognized too late their faith in technologies and financial experimentation (e.g. subprime, exotic financial instruments) could not save their institutions from poor data, lack of data curation and data governance (e.g. latent risks) that created a fantasy of financial reality. A decade later we now recognize that the multi-year post recovery and rebuilding of FSBO’s and their consumer to investor supply chains, created the disruption poised to disintermediate financial products and services beginning in 2021.

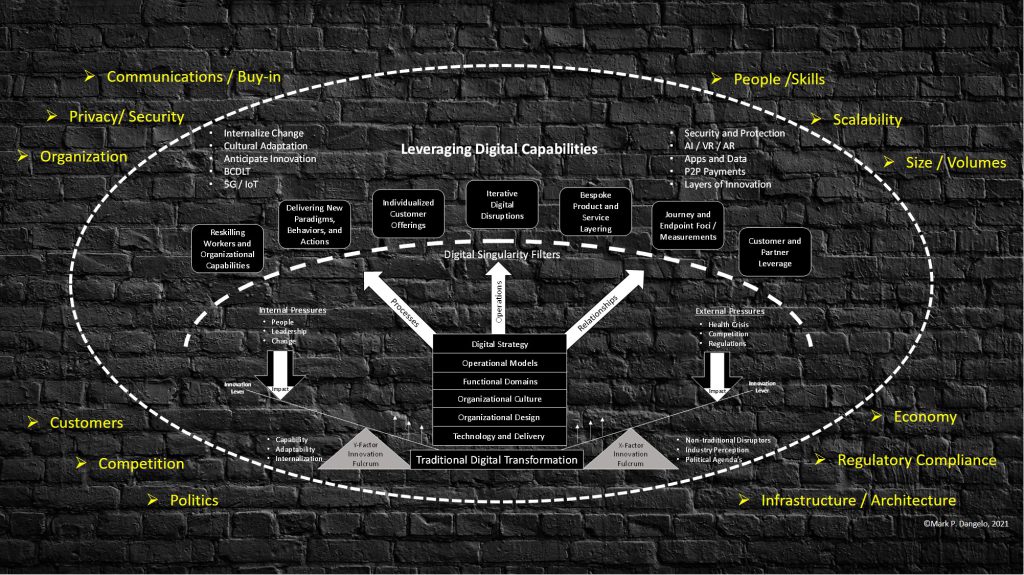

To provide a bit of shock value on how complex the simple idea of data has become is demonstrated in the following graphic. If we continue to focus on a silo of the data and digitization delivery ecosystems for FSBO’s the world seems simpler. Still with the disintermediation of commodity offerings at the push of increasingly common solution frameworks, such as smart contracts and distributed ledger technologies (DLT), the larger picture of what we do, our value in the process and our future importance to the consumer (and our own investors) starts to come into focus.

Roundup

I will leave you with another lesson learned from history — this time from one of the greatest disruptors of his century. Henry Ford was asked after his success, if he followed the customer’s advice when he launched his automobile firm. His response was quoted as, “If I listened to what the customer wanted and told me to create, I would have built a faster horse.” There are many would-be Henry Ford’s out there today — and they are not singularly seeking efficiencies using the data.

We now understand that data, while an asset, also makes the entry into the markets for new and non-traditional competitors easier. The customer drive for digitized information (to streamline and reduce originations and market settlements, e.g., T+1), has changed the math over the last four years and 2020 was the year we expected the rebalancing of market makers to begin.

Covid-19 changed that timeline — but barring another great market or global aberration, the reality of the cycle because of innovation, data and disintermediation will start in 2021. We can see the 2021 events already with the announcement of Walmart seeking to become a FinTech firm, and the 30-year trend of 240+ FDIC institutions lost every year showing no sign of slowing.

There were just over 5,000 FDIC brands starting in January 2021. There will be under 4,000 by the end of 2025. Will you survive these digital transformations, become an M&A statistic, or a brand lost to a market shift that was survivable (but failed to recognize)?

Welcome to the emerging stride of the Fourth Industrial (digital) Revolution.