Commercial lending workflows are changing fast. Higher loan demand, more complex borrower structures, and tighter credit environments all push lenders to evaluate how efficiently they move from document intake to credit decision. Many institutions turn to automation for help, but not all spreading tools are designed for the realities of commercial and SBA lending.

Some automate only portions of the workflow. Others were built for consumer lending or upstream document management rather than detailed financial interpretation. And while many tools claim to “automate spreading,” most still leave analysts doing the hardest parts manually.

This blog breaks down where general-purpose automation falls short, what commercial lenders actually need, and how the right type of automated spreading supports accuracy, speed, and scale.

Key Insights at a Glance

- Many spreading tools were built for document routing, not complex financial analysis.

- Commercial and SBA lending require detailed tax return interpretation across multi-entity structures.

- OCR-only tools struggle with scanned documents, variable layouts, and mixed schedules.

- Standardized spreads and consistent ratio logic are critical for risk assessment.

- The right automation reduces manual prep work so analysts can focus on judgment, not data entry.

- FlashSpread supports commercial lending by combining OCR, machine learning, and evolving AI enhancements to deliver fast, accurate spreads.

Table of Contents

Where General Automation Tools Fall Short

There’s a common belief that most financial automation software “handles spreading.” In practice, many systems stop at file intake and routing, leaving the real work to analysts.

1. OCR Without Intelligence

Basic Optical Character Recognition (OCR) reads printed numbers, but commercial spreading requires far more sophistication. Lenders deal with:

- Hundreds of tax fields across 1040, 1120, 1120-S, and 1065 packages

- Varying layouts from year to year

- Multi-entity borrowers and affiliate structures

- Scanned or imperfect documents

OCR alone often struggles with low-quality scans, handwritten notes, and complex schedules. Analysts end up correcting errors manually, eliminating any productivity gain.

2. Limited Understanding of Tax Documents

Commercial lending depends on an accurate interpretation of:

- 1040 + Schedules C, E, F, and others

- 1120, 1120-S, and 1065 business returns

- K-1s

- Forms 8825 and 1125-A

- Multi-year, multi-entity document packages

Many upstream systems cannot correctly classify or map these forms. Even if extraction begins, analysts often revert to Excel to rebuild spreads.

3. No Normalization or Ratio Logic

Extracting numbers is only step one. True commercial spreading requires:

- Consistent DSCR and Global DSCR logic

- Addback rules

- Standardized cash flow treatment

- Clear mapping of business vs. personal income

Most tools do none of this. Each analyst ends up with their own spreadsheet template: creating risk, inconsistency, and longer review cycles.

4. Not Built for Complex Borrower Structures

Commercial borrowers often involve layered ownership, guarantors, and multiple entities. Generic automation tools cannot interpret these relationships or tie linked financials together. Analysts must manually normalize everything.

5. Automation That Adds Work Instead of Reducing It

Some tools require manual template setup, field mapping, or constant QA. Instead of speeding analysts up, they slow teams down.

What Commercial Lenders Actually Need

Modern credit teams need clarity, consistency, and trustworthy data—not just extraction.

1. Deep Tax-Form Intelligence

A commercial-grade tool must interpret fields across:

- Full sets of 1040 schedules

- K-1 pass-through income

- Depreciation, amortization, addbacks

- Schedule L balance sheet items

- 1120, 1120-S, 1065 packages

- Forms 8825 and 1125-A

This is the technical heart of automated spreading.

2. Accuracy Across Real-World Documents

Lenders rarely receive pristine PDFs. Automation must work with:

- Scanned files

- Mixed formats

- Multi-year packages

- Supporting schedules

This requires machine learning and small AI components—not OCR alone.

3. Consistent Ratio and Cash-Flow Logic

For meaningful risk evaluation, DSCR, Global DSCR, and other key ratios must be applied consistently across borrowers and analysts.

4. Standardized Outputs

A strong spreading tool ensures consistent:

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- Classification

- Addbacks

- Calculations

- Output formatting

This reduces review time and makes audits far smoother.

5. True Time Savings

If automation still requires rekeying, rebuilding, reconciling, or rewriting, it’s not automation.

Where Automation Helps, and Where Humans Still Matter

AI-enhanced spreading changes what analysts spend time on, but it does not replace credit expertise.

What automation does well:

- Extracts and organizes data

- Applies consistent logic

- Flags anomalies

- Reduces turnaround time

What analysts do best:

- Interpret trends

- Understand borrower behavior

- Evaluate forward-looking risk

- Make judgment calls regulators expect

The strongest operations adopt a hybrid model: automation prepares clean data, humans drive the credit decision.

How FlashSpread Meets the Needs of Commercial Credit Teams

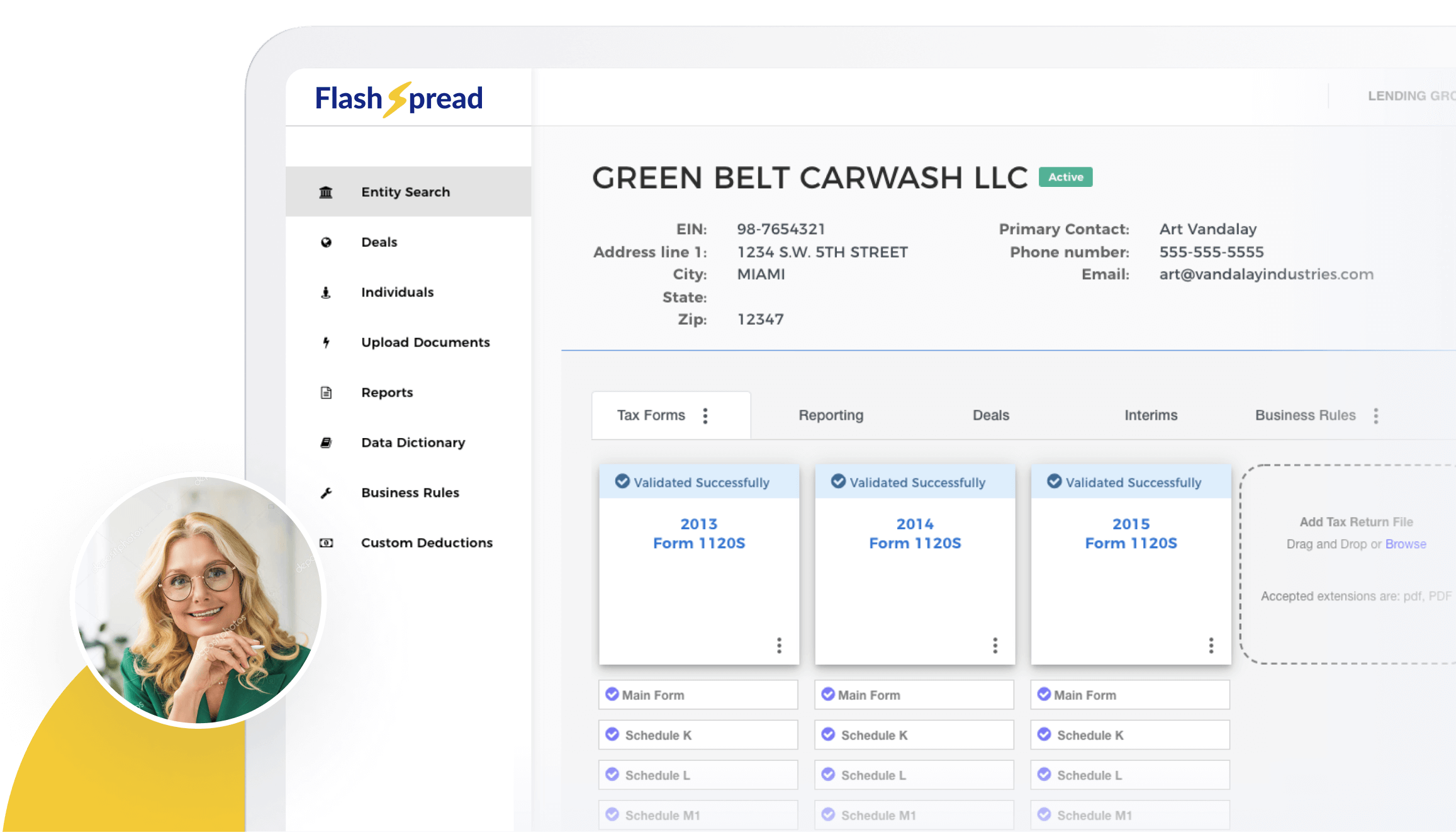

FlashSpread was built for commercial and SBA lenders who process large volumes of tax returns and financial statements. Its value lies in eliminating the manual prep that slows lending teams down.

Fast, Accurate Extraction

Using OCR + machine learning, FlashSpread processes:

- 1040 and all major schedules (1, A, B, C, D, E, F)

- 1120, 1120-S, 1065 and their schedules (K, K-1, L, M-1, M-2)

- Forms 8825 and 1125-A

- W-2s and 1099-MISC

- Business financial statements (currently in beta)

Minutes-Fast Spreads

The platform reduces spreading time from ~3 hours to ~5 minutes, a direct lift in operational capacity.

Consistent Outputs

FlashSpread delivers standardized spreads, ratio logic, global debt service calculations, and audit-ready data.

AI Enhancements That Improve Over Time

FlashSpread’s machine learning and evolving AI help:

- Classify line items

- Improve mapping accuracy

- Reduce manual corrections

- Normalize multi-entity borrower structures more effectively

FlashSpread doesn’t eliminate analysts. It amplifies them, giving teams cleaner, more reliable financial data so they can focus on judgment, not transcription.

Q&A: Common Questions About Automated Spreading

Q. Does automated spreading work for multi-entity or complex tax returns?

A. Yes. Modern automation can structure multi-entity tax packages into clear, comparable spreads, reducing the reconciliation work analysts typically perform.

Q. Will automation replace analysts?

A. No. It handles repetitive prep work so analysts can focus on credit interpretation, risk evaluation, and borrower relationships.

Q. Can automated spreading integrate with an LOS?

A. Yes. Tools like FlashSpread integrate directly, closing the gap between document intake and fully analyzed financial spreads.

Roundup

Commercial lending requires a level of nuance and accuracy that general-purpose automation tools simply weren’t built to deliver. Most platforms stop at document intake, leaving the heavy lifting—extraction, normalization, ratio logic—entirely in the hands of analysts.

The right automated spreading changes that. When lenders adopt tools built specifically for commercial workflows, they gain consistent outputs, faster turnaround times, stronger risk visibility, and greater capacity without adding headcount.

FlashSpread supports this evolution, giving analysts clean, reliable financial data so they can make confident credit decisions with less manual effort.

Get a closer look at how modern automated spreading supports accuracy, speed, and consistency across commercial credit workflows. See what smarter spreading looks like in practice.