Speed and accuracy are critical in commercial lending, especially when it comes to credit analysis, risk mitigation, and competitive response times. The faster a lender can process financial documents and assess borrower risk, the better positioned they are to win deals and grow their portfolios. Yet, traditional processes are often too slow and manual to keep pace with modern business needs.

According to a survey by Abrigo, 35% of lenders identified repeated data entry as the largest obstacle in their commercial lending process. Furthermore, nearly two-thirds of respondents reported they re-enter the same data point up to five times per loan. These bottlenecks not only slow down internal operations but also introduce risk, drive up costs, and strain borrower relationships.

To meet growing demand for faster, data-driven decisions, commercial lenders are turning to automation technologies. These tools allow institutions to move from reactive to proactive, using immediate insights to guide underwriting, reduce manual work, and improve portfolio performance.

Table of Contents

What Is Automated Financial Analysis in Commercial Lending?

Automated financial analysis involves the immediate collection, analysis, and utilization of data as it becomes available. In the context of commercial lending, this means that lenders can access up-to-the-minute information on borrowers’ financial statuses, market conditions, and other relevant factors, enabling them to make informed decisions swiftly.

This approach contrasts with traditional methods that rely on historical data and periodic reports, which can lead to delays and less accurate assessments. By leveraging automation, lenders can respond promptly to changes, reducing risks and improving service quality.

Accelerating Loan Origination and Underwriting

Traditional commercial loan origination involves a lengthy back-and-forth between borrowers, brokers, and internal teams. Data often arrives in fragmented batches—bank statements, tax returns, credit reports—and each delay compounds time to approval.

With automated financial analysis, lenders can automate document collection, extract key data points instantly, and flag missing or conflicting information in real time. This speeds up underwriting and allows for conditional approvals to be made much faster.

Manual input is reduced, which minimizes human error and results in cleaner files and faster closings. These improvements benefit both lenders and borrowers, who expect quick, professional service.

Smarter, More Responsive Risk Management

Risk assessment in commercial lending requires evaluating many variables: borrower credit health, cash flow trends, collateral value, and macroeconomic factors.

Automated analysis allows for dynamic risk models. For example, if a borrower’s business suddenly experiences a revenue drop or their industry shows signs of stress, lenders can get notified instantly. They can re-evaluate exposure, adjust loan terms, or flag the account for further review.

This kind of responsiveness isn’t possible with static, monthly reports. It gives credit teams the ability to act decisively and minimize potential losses before they escalate.

Improving Compliance and Audit Preparedness

Regulatory compliance is a critical aspect of commercial lending. Automated financial analysis facilitates adherence to regulations by ensuring that all transactions and decisions are documented and accessible instantly. This transparency simplifies the audit process, as auditors can retrieve necessary information without delays.

Additionally, automated systems can automatically flag non-compliant activities, enabling immediate corrective actions. This proactive approach reduces the risk of penalties and enhances the institution’s reputation for reliability and integrity.

More Personalized and Competitive Borrower Experiences

Today’s commercial borrowers expect their financial partners to understand their business and provide tailored solutions quickly. A static lending experience, where each interaction requires waiting for reviews and manual checks, can frustrate clients and push them toward more agile competitors.

Automated financial analysis lets lenders personalize offers based on up-to-date business performance or market trends. For instance, a lender could automatically trigger a line-of-credit increase based on improved cash flow metrics or offer better terms when industry conditions shift favorably.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

These fast, proactive touches help lenders stand out and strengthen client loyalty.

Operational Efficiency and Scalability

Efficiency isn’t just about working faster; it’s about doing more with less. Automated systems reduce the need for manual intervention in many steps of the commercial lending process, from data entry to risk flagging.

This streamlining allows institutions to handle more volume without proportionally increasing headcount or overhead. For growing lenders, this scalability is essential. Whether you’re managing $50 million or $5 billion in commercial loans, your systems need to keep pace.

With real-time automation in place, lenders can confidently scale without sacrificing accuracy, compliance, or borrower service.

Integrating Automated Financial Analysis with Existing Lending Systems

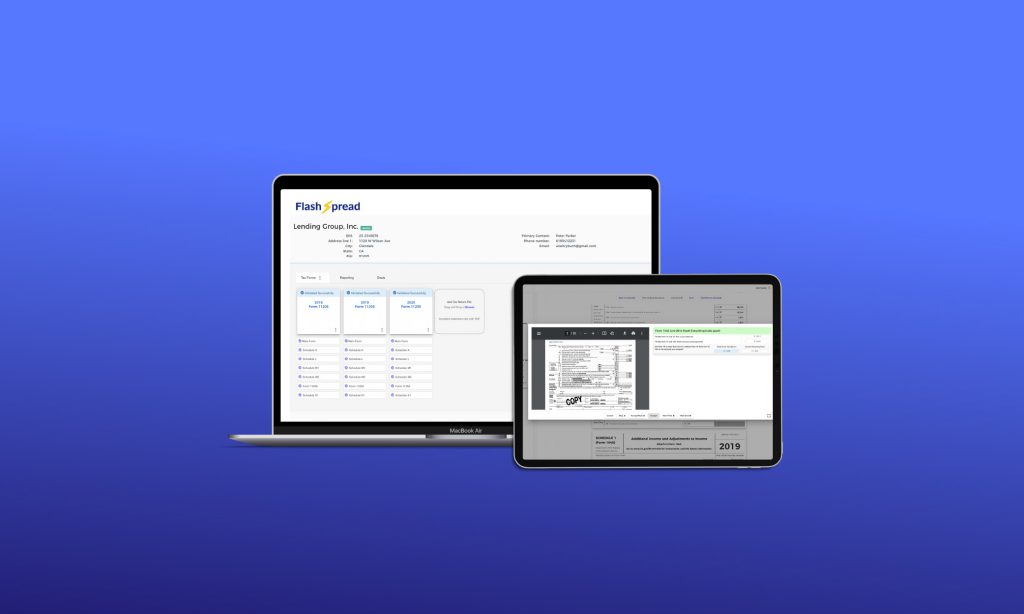

The transition to automated financial analysis doesn’t require a complete technology overhaul. Many modern platforms, including BeSmartee’s commercial lending solution, FlashSpread, are designed to integrate with existing core systems.

This lets institutions adopt new capabilities without disrupting workflows. By starting with key areas such as borrower onboarding or document collection, lenders can begin seeing the benefits almost immediately.

Modernization doesn’t require custom development anymore. With configurable tools, even smaller teams can move toward smarter, more data-driven operations.

BeSmartee’s FlashSpread Is Your Automated Analysis Advantage

One of the most time-consuming tasks in commercial lending has long been financial spreading, manually entering tax return data into spreadsheets or systems. It’s slow, prone to errors, and not scalable.

FlashSpread solves this with OCR (optical character recognition) and intelligent parsing, converting scanned business tax returns into structured, usable data in seconds. What once took hours now takes moments, with greater accuracy.

Here’s how FlashSpread is making automated financial analysis a practical reality for commercial lenders:

- Faster underwriting: Automates the extraction and calculation of financial ratios, helping credit analysts move quickly.

- Greater accuracy: Reduces human error and produces standardized outputs, crucial for consistent credit decisions and audit readiness.

- Scalability: Allows teams to process more loans without increasing staff, making it easier to expand portfolios efficiently.

- Audit-ready documentation: Every data point is traceable to the source document, ensuring strong compliance and quality control.

By streamlining a key step in commercial lending, FlashSpread helps lenders realize the full value of automated analysis, not just for reporting, but deep within day-to-day workflows.

Roundup

In commercial lending, timing matters. Opportunities are won or lost based on how quickly lenders can evaluate risk, respond to client needs, and deliver solutions. Automated financial analysis makes this speed possible without compromising accuracy or compliance.

As the industry continues to digitize, lenders who embrace real-time systems will not only improve internal operations but also build stronger, more responsive relationships with their clients.

If you’re ready to see how FlashSpread can help your team make better and faster decisions, get in touch today and explore our commercial lending solution.