Every lender wants more borrowers to move from application to approval. But in today’s lending environment, getting there isn’t as simple as collecting more leads. Borrowers are applying online more than ever, yet abandonment rates across digital mortgage applications remain a challenge. According to The MortgagePoint, about 68% of applications are abandoned before completion, often due to confusing forms, redundant data entry, and slow response times that make the process feel disconnected.

And while many lenders try to fix conversion by adding manual reviews or more staff oversight, the real opportunity lies elsewhere, in automating smarter, simplifying processes, and letting technology do the heavy lifting.

Here’s how lenders can increase borrower conversion rates without adding more work.

Key Insights at a Glance

- Application abandonment often stems from friction in early-stage applications, not lack of interest.

- Automation and configurable workflows can reduce manual review time and improve speed to approval.

- Data visibility helps lenders identify bottlenecks and target where conversions stall.

- A modern mortgage point-of-sale (POS) bridges marketing and loan teams, helping convert more qualified applicants into approved borrowers.

Table of Contents

The Hidden Cost of Application Abandonment

When an applicant starts a mortgage application but doesn’t finish, the lender loses more than a lead—they lose revenue.

Incomplete or abandoned applications clog pipelines, skew performance metrics, and consume staff time that could be spent closing qualified borrowers.

Three key friction points often cause these drop-offs:

- Application confusion: Borrowers don’t understand what’s required or where they are in the process.

- Document overload: Manual uploads and redundant data entry create frustration.

- Delayed response: When loan officers can’t follow up quickly, motivated borrowers lose momentum.

The result? Lower conversion rates, longer cycle times, and higher acquisition costs.

The fix isn’t to work harder but to work smarter, automating the repetitive and removing friction before it stalls the borrower journey.

Simplify the Borrower Experience

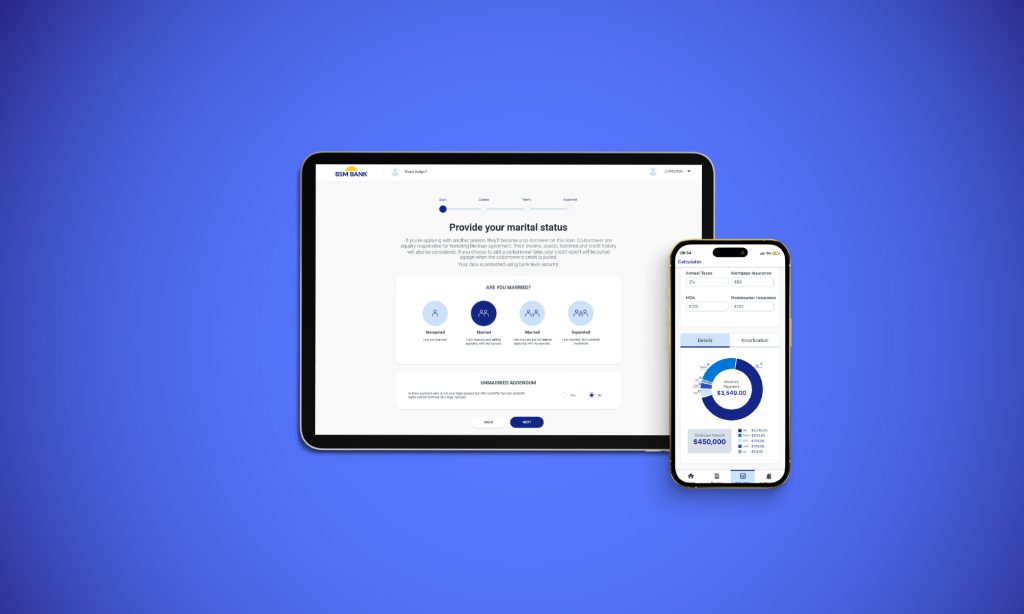

Conversion begins with clarity and ease. When borrowers understand what’s required and can complete it smoothly, they’re more likely to convert.

Effective tactics include:

- Guided forms that dynamically adjust based on inputs

- Mobile-friendly design so applicants can start on one device and continue on another

- Live status updates showing progress and next steps

- Tooltips and help content embedded in the application flow

Beyond design, education plays a big role. Borrowers, especially first-time buyers, benefit from in-app explanations or micro-guides that demystify each step. By adding contextual help, short videos, or FAQ links directly inside the POS interface, lenders can reduce confusion while keeping applicants engaged. Even a few seconds saved per step adds up to smoother completion and stronger borrower confidence

Automate What Slows You Down

Manual tasks like re-keying data, chasing missing documents, or routing applications add up and slow everything else. Automation is your lever to boost throughput without scaling effort.

With a configurable POS, you can:

- Auto-populate fields via integrations

- Trigger reminders or notifications for missing items

- Route workflows to the right teams based on loan type or geography

STRATMOR’s 2024 Technology Insight Study notes growing adoption of automation and digital tools among lenders. As more lenders deploy these tools, their ability to reduce manual drag becomes a key competitive differentiator.

In other words, automation doesn’t just reduce workload but multiplies team capacity. Each repetitive task automated frees up valuable minutes that can be reinvested in personal borrower outreach, faster review cycles, and cleaner handoffs between departments.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Use Data to Pinpoint Application Abandonment

Knowing where borrowers quit is the first step to preventing it. Instead of relying on guesswork, lenders can use analytics dashboards to uncover hidden friction, like time-consuming data entry fields, confusing terminology, or unclear progress indicators, that cause hesitation.

Start by tracking three metrics:

- Application starts vs. completions – reveals overall funnel health.

- Average time in each stage – identifies bottlenecks that slow approvals.

- Abandonment per step – pinpoints which pages or actions cause confusion.

Once these metrics are visible, small adjustments, like reducing redundant fields or adding real-time guidance, can create measurable improvement. Even a modest 2% increase in completion rate across high-volume loan types can drive a significant lift in closed loans and revenue over time.

Empower Your Loan Officers

Loan officers are pivotal, but they should not be buried under an administrative burden. The goal is to use technology to augment, not replace, their relationship strength.

By automating updates, reminders, and document management, a modern POS frees LOs to focus on strategic engagement, reviews, and overcoming underwriting obstacles. Many lenders also find that real-time collaboration tools such as chat functions, borrower notes, and automated alerts help LOs stay proactive rather than reactive. This balance of human + tech often leads to better borrower experience and higher conversion.

Technology as the Loyalty Engine

Relationships power borrower loyalty, but technology makes it scalable. A best-practice, conversion-driven mortgage POS acts as a revenue engine—built to deliver consistency, clarity, and speed across every borrower touchpoint through intelligent automation and proven workflows.

Bright POS turns this approach into results. Lenders using Bright report an industry-leading 80–85% application-to-borrower conversion rate, proof that better design and smarter automation directly drive completions.

Here’s how that shows up in action:

- For applicants: A clean, guided digital interface helps them complete applications faster and with confidence.

- For loan officers: Automation handles routine tasks, enabling them to better engage borrowers.

- For lenders: A measurable lift in ROI from improved conversion rates, shorter cycle times, and reduced overhead, creating a direct impact on profitability and long-term borrower retention.

The result: fewer abandoned starts, more qualified approvals, and a smoother borrower journey from beginning to end.

Q&A: Borrower Conversion in Practice

Q: What’s the main reason applicants abandon their application mid-process?

A: Complexity. If forms feel redundant or unclear, applicants lose momentum and often abandon them.

Q: Can smaller lenders match big institutions’ conversion?

A: Yes. Smaller lenders often already have advantages in local service, faster responsiveness, and stronger borrower relationships. When those strengths are combined with automation and streamlined processes, they can compete effectively.

Roundup

Lifting borrower conversion isn’t about working harder or spending more money; it’s about optimizing what already works—streamlining workflows, automating intelligently, and focusing your team’s time where it truly impacts borrowers.

Bright isn’t just another mortgage POS; it’s a revenue engine. With configurable automation and borrower-first design, lenders can convert more applicants into approvals without adding headcount or budget. The result: higher ROI, better borrower satisfaction, and a more scalable business model.

Explore how Bright POS helps lenders move more borrowers from application to approval, efficiently, predictably, and without extra strain on your team.