Global shifts, such as tariffs, interest rate changes, and supply chain hiccups, no longer stay overseas. They land squarely in the mortgage landscape. Imported material costs impact affordability, rate volatility affects borrowers’ decisions, and global uncertainty raises the demand for clear lender guidance. These trends, once distant concerns, now have a direct and measurable influence on loan pricing, borrower qualification, and lending operations.

For mortgage professionals, the stakes are higher, but so are the opportunities. While these challenges demand more from lenders, they also open the door for innovation and the adoption of agile, borrower-first strategies.

This post unpacks how these economic forces influence mortgage lending and discusses strategies that lenders can employ for adaptation and resilience.

Table of Contents

The Tariff Ripple Effect on Housing Supply and Affordability

Recent U.S. tariffs on imported building materials, such as lumber, steel, and glass, are substantially increasing the cost of new homes. Redfin reports that builders anticipate an average of $9,200 additional cost per home due to these tariffs, which directly affects home affordability and shifts loan-to-value ratios.

On a broader level, Redfin also found that 68% of U.S. homeowners and renters believe tariffs could fuel inflation and prolong high interest rates. These perceptions highlight how international trade policy influences borrower confidence and the cost of capital. As these pressures build, lenders may see longer rate-tightening cycles and need to rethink pricing models and borrower communications.

Consider a scenario where rising material prices push monthly housing costs beyond a borrower’s budget. In these cases, lenders may need to compensate by offering longer amortization schedules, rate buydowns, or even advising on alternative housing options. Each of these adjustments requires flexible underwriting and pricing strategies, as well as clear communication to support borrower decision-making in uncertain times.

Central Bank Signals and Mortgage Rate Volatility

Monetary policy remains a key influence on mortgage markets. When central banks raise or lower interest rates in response to inflation or economic slowdowns, lenders must recalibrate their offerings. Rate hikes cool borrowing demand, while cuts often flood lenders with applications for refinancing and home purchases.

The challenge for lenders is not just anticipating central bank moves but also reacting to them efficiently. A slow response to rate changes can cost market share or compress margins. Technology and automation in pricing engines become vital to staying competitive and compliant.

Inflation and the Borrower’s Cost-of-Living Equation

Inflation has a twofold effect: it erodes purchasing power and shifts borrower sentiment. Higher consumer prices can stretch household budgets, leading borrowers to opt for smaller homes or delay homeownership altogether. This creates a ripple effect on loan sizes, credit risk, and product selection.

For mortgage lenders, this means recalibrating affordability models and updating borrower education strategies. It’s no longer enough to offer competitive rates; lenders must also explain how global inflationary pressures may influence future payment structures and interest adjustments.

Supply Chain Disruptions and Construction Timelines

Global supply chain issues, whether caused by geopolitical instability or shipping delays, are slowing home construction and repair projects. This affects home values, builder confidence, and the timing of loan disbursements. Delays in construction timelines can lead to loan lock extensions, interest rate relocks, or even pipeline fallout.

To stay resilient, lenders should implement flexible workflow systems that accommodate shifting timelines, offer proactive communications with borrowers and builders, and streamline document updates to shore up trust during uncertain times.

Technology as a Stabilizing Force in a Global Economy

Amid ongoing global market fluctuations, technology plays a pivotal role in stabilizing mortgage operations. Lenders equipped with modern platforms can more effectively manage disruptions like sudden rate hikes or construction delays.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Here’s how technology acts as a stabilizer:

- Real-time rate updates: Stay responsive to global market shifts with automated pricing tools.

- Instant disclosure delivery: Ensure compliance and reduce delays during volatile windows.

- Consistent borrower experience: Use self-serve portals and mobile apps to provide transparency and engagement regardless of economic shifts.

- Workflow automation: Eliminate bottlenecks caused by manual processing or outdated systems.

- Data-driven insights: Monitor borrower trends and pipeline health with better reporting and analytics.

To stay competitive and responsive, lenders must embrace digital transformation as a practical step, not a long-term vision, but a present-day necessity.

How BeSmartee Helps Lenders Thrive Through Uncertainty

With global economic forces influencing everything from housing affordability to rate stability and loan processing timelines, lenders need digital tools that help them adapt fast. BeSmartee addresses this need with a flexible, scalable approach designed specifically for today’s volatile lending environment.

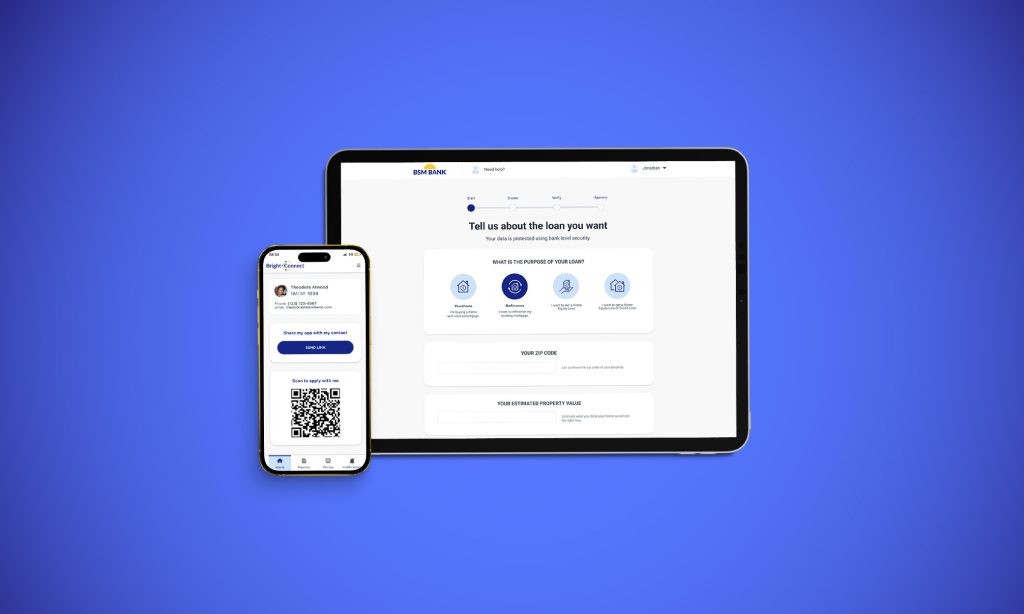

Our Bright POS and Bright Connect mobile app allow mortgage lenders to respond to macroeconomic disruptions—like tariffs driving up material costs, supply chain delays affecting property readiness, or rate fluctuations triggered by central bank decisions—with agility and confidence.

Through a configurable SaaS model, our solution enables lenders to:

- Quickly reconfigure workflows to account for market shifts

- Adjust disclosures, pricing, and borrower communications in real time

- Scale operations without increasing overhead or sacrificing service quality

- Maintain transparency and speed, even when processing timelines become unpredictable

This technology-driven flexibility allows lenders to stay ahead of market pressures, offer better service, and reduce risk, without slowing down operations or requiring a heavy IT lift.

Bright POS and Bright Connect power a more adaptive lending experience, built for resilience in the face of today’s global economic headwinds.

Strategic Takeaways for Lenders

To remain competitive amid global economic uncertainty, lenders should consider the following strategies:

- Monitor global trade and monetary policy to understand potential housing market implications.

- Use dynamic pricing and underwriting tools to reflect changing borrower affordability.

- Educate borrowers on how macroeconomic events may impact their homeownership journey.

- Invest in automation to minimize delays and enhance service, especially during volatile periods.

- Choose scalable tech solutions that evolve with your operational and compliance needs.

Roundup

From tariffs and interest rate swings to global supply challenges and inflation, today’s lenders face a complex economic landscape. These forces may seem external, but their impact is deeply local, affecting borrower behavior, loan pricing, and operational agility.

Mortgage lenders who succeed in this environment are those who can combine a proactive strategy with adaptable technology. By staying current on economic indicators, adopting configurable tools, and educating borrowers, lenders can remain competitive no matter the headwinds.

Digital transformation is no longer optional, but it’s a foundation for long-term resilience, empowering lenders to navigate uncertainty with speed and flexibility.

Ready to navigate economic uncertainty with confidence? Contact us to learn how our solutions can help your team automate, clarify, and compete—without compromise.