More mortgages,

fewer clicks.

HW Tech 100

2019・2020・2021

2022・2023・2024

The Stevie® Awards

2021・2022・2023

HW Women of influence

2020

Stevie People’s Choice TPO

2022

Titan Business Awards

2022

Why BeSmartee

Our Products

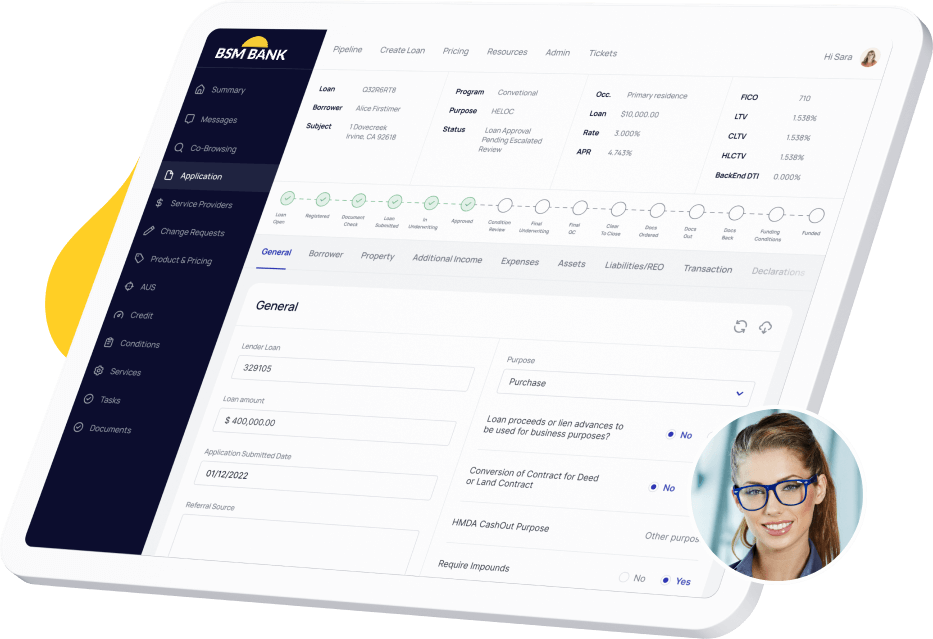

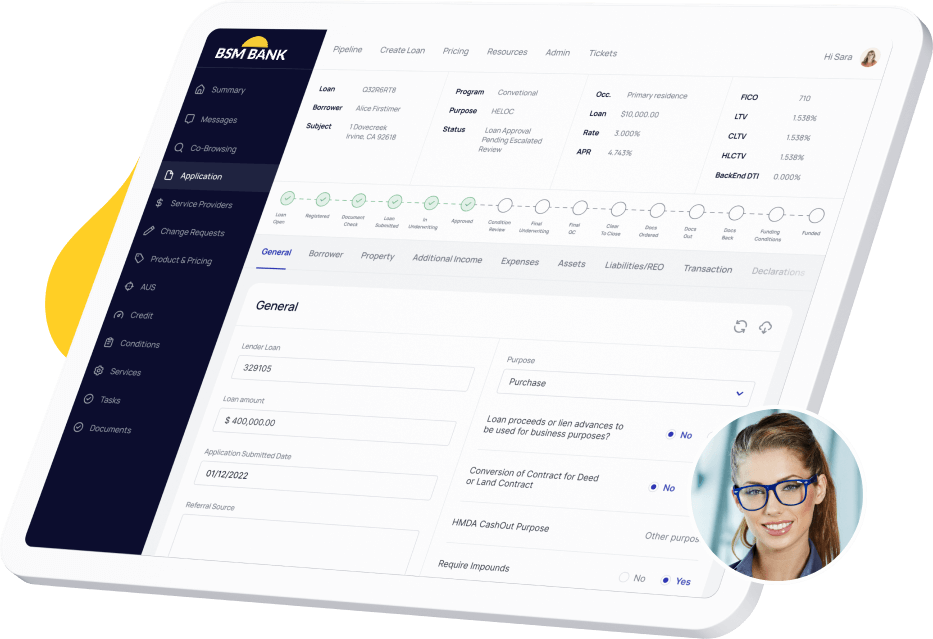

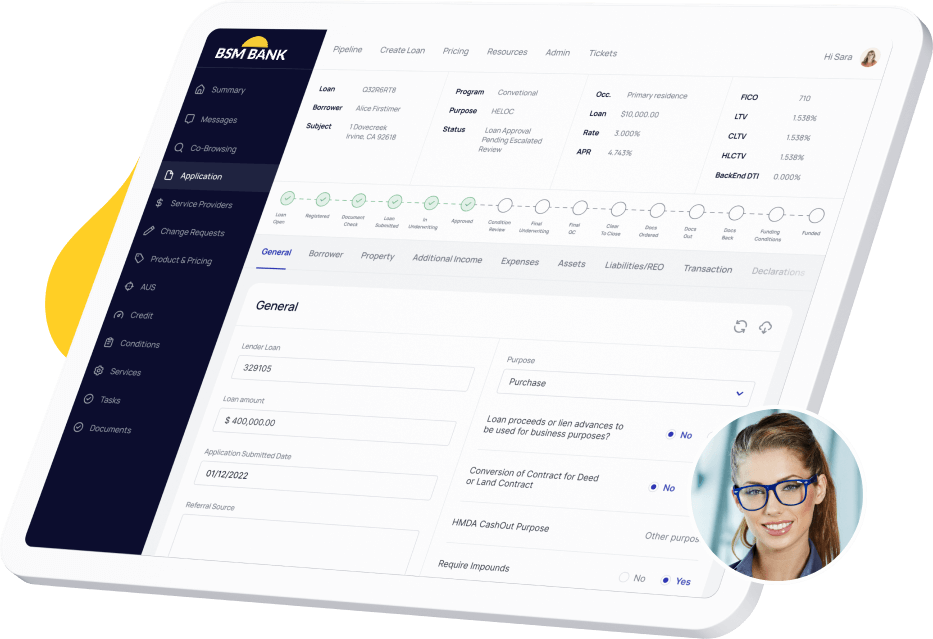

A true digital mortgage platform improves your consumer and lender experience, reduces costs, and reduces cycle times.

A powerful digital mortgage POS with LOS integration, automated VOIE, automated letter generation and more.

Learn moreEnhance collaboration and efficiency among originators, referral partners and borrowers.

Learn moreTestimonials